Some Investors May Be Worried About Wonderful Sky Financial Group Holdings' (HKG:1260) Returns On Capital

What financial metrics can indicate to us that a company is maturing or even in decline? When we see a declining return on capital employed (ROCE) in conjunction with a declining base of capital employed, that's often how a mature business shows signs of aging. This reveals that the company isn't compounding shareholder wealth because returns are falling and its net asset base is shrinking. On that note, looking into Wonderful Sky Financial Group Holdings (HKG:1260), we weren't too upbeat about how things were going.

This technology could replace computers: discover the 20 stocks are working to make quantum computing a reality.

Return On Capital Employed (ROCE): What Is It?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Wonderful Sky Financial Group Holdings:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.0016 = HK$2.4m ÷ (HK$1.6b - HK$121m) (Based on the trailing twelve months to September 2024).

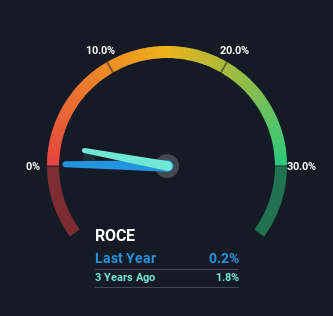

Therefore, Wonderful Sky Financial Group Holdings has an ROCE of 0.2%. In absolute terms, that's a low return and it also under-performs the Media industry average of 9.4%.

See our latest analysis for Wonderful Sky Financial Group Holdings

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how Wonderful Sky Financial Group Holdings has performed in the past in other metrics, you can view this free graph of Wonderful Sky Financial Group Holdings' past earnings, revenue and cash flow .

The Trend Of ROCE

In terms of Wonderful Sky Financial Group Holdings' historical ROCE movements, the trend doesn't inspire confidence. About five years ago, returns on capital were 9.5%, however they're now substantially lower than that as we saw above. On top of that, it's worth noting that the amount of capital employed within the business has remained relatively steady. This combination can be indicative of a mature business that still has areas to deploy capital, but the returns received aren't as high due potentially to new competition or smaller margins. So because these trends aren't typically conducive to creating a multi-bagger, we wouldn't hold our breath on Wonderful Sky Financial Group Holdings becoming one if things continue as they have.

On a side note, Wonderful Sky Financial Group Holdings has done well to pay down its current liabilities to 7.6% of total assets. That could partly explain why the ROCE has dropped. What's more, this can reduce some aspects of risk to the business because now the company's suppliers or short-term creditors are funding less of its operations. Since the business is basically funding more of its operations with it's own money, you could argue this has made the business less efficient at generating ROCE.

The Bottom Line

All in all, the lower returns from the same amount of capital employed aren't exactly signs of a compounding machine. Investors haven't taken kindly to these developments, since the stock has declined 49% from where it was five years ago. Unless there is a shift to a more positive trajectory in these metrics, we would look elsewhere.

One more thing: We've identified 2 warning signs with Wonderful Sky Financial Group Holdings (at least 1 which doesn't sit too well with us) , and understanding these would certainly be useful.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

If you're looking to trade Wonderful Sky Financial Group Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wonderful Sky Financial Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10