RPM International Analysts Slash Their Forecasts After Downbeat Earnings

RPM International Inc. (NYSE:RPM) reported worse-than-expected third-quarter financial results on Tuesday.

Sales declined 3% year over year to $1.48 billion, missing the consensus of $1.51 billion. Adjusted EPS was 35 cents, missing the consensus of 49 cents.

Frank C. Sullivan, RPM chairman and CEO said, "Unseasonably cold weather in the southern U.S. and wildfires in the west reduced demand in geographies that typically have more construction and outdoor project activity in winter months."

"As we look toward the fourth quarter, macroeconomic conditions are challenging, but we are seeing pockets of positive momentum and are leveraging our focus on repair and maintenance in both construction and consumer end markets. As demonstrated in prior economic cycles, the ability of our products and services to extend asset life becomes even more attractive to end users when budgets are tight."

For the fourth quarter, RPM expects consolidated sales to remain flat compared to prior-year records.

RPM shares dipped 9.1% to close at $96.97 on Tuesday.

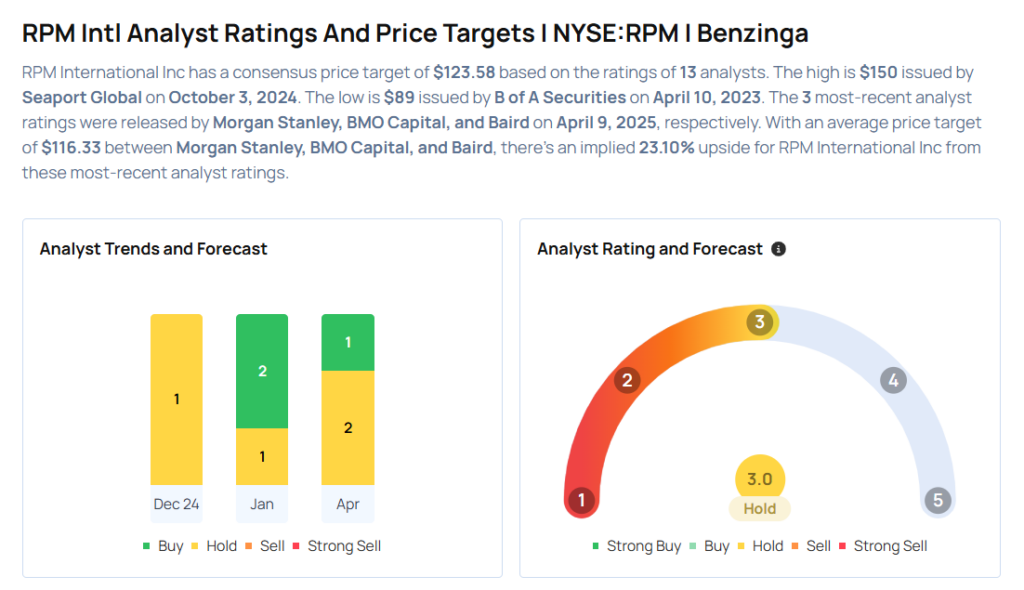

These analysts made changes to their price targets on RPM International following earnings announcement.

- Baird analyst Ghansham Panjabi maintained RPM Intl with a Neutral and lowered the price target from $125 to $110.

- BMO Capital analyst John McNulty maintained the stock with an Outperform rating and lowered the price target from $154 to $126.

- Morgan Stanley analyst Vincent Sinisi maintained RPM with an Equal-Weight rating and cut the price target from $125 to $113.

Considering buying RPM stock? Here’s what analysts think:

Read This Next:

- Top 3 Industrials Stocks You May Want To Dump This Month

Photo via Shutterstock

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10