Yum China Holdings (NYSE:YUMC) Appoints Adrian Ding as New CFO

Yum China Holdings (NYSE:YUMC) experienced a recent leadership shift with the appointment of Adrian Ding as its new CFO on March 6, 2025. This executive change may underscore Yum China's commitment to solidifying its financial strategies amidst a challenging market scenario. During the last quarter, while the company maintained a flat price move despite a broader market decline and heightened volatility attributed to new tariff regulations, its increased dividend payout, robust earnings performance, and aggressive store expansion plans could have provided some counterbalance against market pressures, reflecting a stable outlook amid turbulent trading conditions.

Yum China Holdings has 2 possible red flags we think you should know about.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Yum China Holdings' leadership change with the appointment of Adrian Ding as CFO could influence strategic financial maneuvers aimed at enhancing shareholder value. Despite market volatility and recent tariff challenges, Yum China's planned store expansions and digital initiatives are anticipated to support future operational efficiency and shareholder returns. Over the past year, the company's total return, including dividends, was 14.42%, signifying resilience amid turbulent conditions. Notably, Yum China's one-year return outpaced the US market's 3.8% decline and the US Hospitality industry's 9% decline, reflecting its robust performance in a broader context.

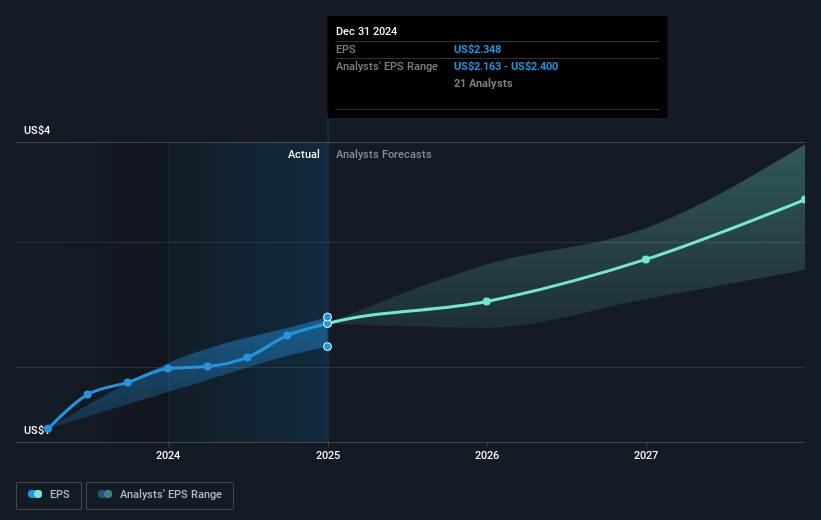

The shift in CFO may refine Yum China's revenue and earnings projections, aligning its financial strategies with market demands and technological advancements. Revenue growth hinges on continued market expansion and successful execution of digital and franchise initiatives. Analysts forecast the company's earnings to reach US$1.1 billion by 2028, fueled by a 6.5% annual revenue increase and slight margin improvements. The current stock price of US$52.95 presents an 11% gap to the consensus price target of US$59.52. This difference underscores potential growth and reflects market confidence in Yum China's long-term strategies.

Gain insights into Yum China Holdings' future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Yum China Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10