Bitget plans to burn $120 million worth of BGB under new quarterly mechanism

Bitget is set to burn more than 30 million BGB for the first quarterly burn of 2025. The crypto exchange has recently updated its burn mechanism according to on-chain usage.

According to a press release sent to crypto.news on April 9, the crypto exchange will be using a new burn mechanism for its native token that takes into account more of its on-chain usage. The new mechanism uses a utility-based model to calculate the amount of Bitget Tokens (BGB) to burn.

The updated burn formula directly links quarterly burn volumes to the amount of BGB paid to on-chain gas fees through the firm’s GetGas accounts. Under the new mechanism for Q1 2025, the platform added approximately 6,943 BGB to its GetGas accounts.

Therefore, Bitget is preparing to burn a total of 30 million BGB for this quarter, which is equal to more than $120 million based on current market prices. This means that 30 million BGB will be removed from its total token supply, potentially boosting the remaining token’s value.

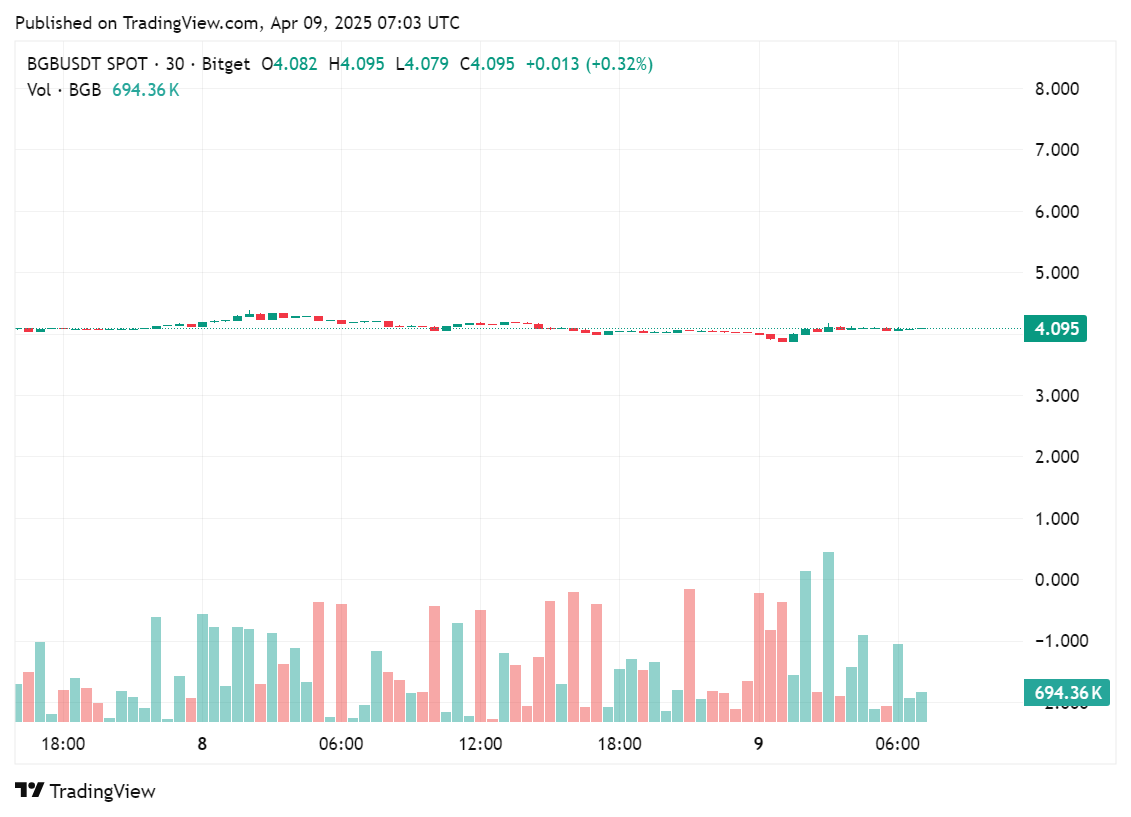

At press time, BGB has gone down nearly 2.5% in the past 24 hours. It is currently trading hands at $4.07, despite reaching a $4.20 a day prior. The token is still more than 50% below its all-time high of $8.45, which was recorded at the end of December 2024.

BGB’s circulating supply stands at 1.2 billion BGB with a 24-hour trading volume of $278 million. The token’s trading volume experienced a 13% boost compared to the previous trading day. Meanwhile, the token’s market cap is currently valued at nearly $5 billion.

CEO of Bitget, Gracy Chen, stated that a more sustainable burn mechanism was an expected change, considering BGB is in the process of expanding its role within various on-chain ecosystems.

“By linking its burn mechanism to actual on-chain utility, BGB’s quarterly burn amount can evolve with real usage. This update incentivizes adoption and enables transparent and sustainable tokenomics,” said Chen in her statement.

In January 2025, the crypto exchange burned 800 million BGB held by the internal team, which represented 40% of the total supply. This burn reduced the token’s circulating supply from 2 billion BGB to 1.2 billion BGB.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10