Coca-Cola Consolidated (NASDAQ:COKE) Is Very Good At Capital Allocation

If you're looking for a multi-bagger, there's a few things to keep an eye out for. Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. With that in mind, the ROCE of Coca-Cola Consolidated (NASDAQ:COKE) looks great, so lets see what the trend can tell us.

Trump has pledged to "unleash" American oil and gas and these 15 US stocks have developments that are poised to benefit.

Return On Capital Employed (ROCE): What Is It?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Coca-Cola Consolidated:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.23 = US$918m ÷ (US$5.3b - US$1.3b) (Based on the trailing twelve months to December 2024).

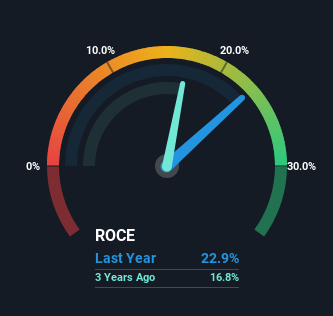

Thus, Coca-Cola Consolidated has an ROCE of 23%. In absolute terms that's a great return and it's even better than the Beverage industry average of 17%.

Check out our latest analysis for Coca-Cola Consolidated

Historical performance is a great place to start when researching a stock so above you can see the gauge for Coca-Cola Consolidated's ROCE against it's prior returns. If you're interested in investigating Coca-Cola Consolidated's past further, check out this free graph covering Coca-Cola Consolidated's past earnings, revenue and cash flow .

What Does the ROCE Trend For Coca-Cola Consolidated Tell Us?

We like the trends that we're seeing from Coca-Cola Consolidated. Over the last five years, returns on capital employed have risen substantially to 23%. Basically the business is earning more per dollar of capital invested and in addition to that, 60% more capital is being employed now too. This can indicate that there's plenty of opportunities to invest capital internally and at ever higher rates, a combination that's common among multi-baggers.

Our Take On Coca-Cola Consolidated's ROCE

In summary, it's great to see that Coca-Cola Consolidated can compound returns by consistently reinvesting capital at increasing rates of return, because these are some of the key ingredients of those highly sought after multi-baggers. Since the stock has returned a staggering 464% to shareholders over the last five years, it looks like investors are recognizing these changes. Therefore, we think it would be worth your time to check if these trends are going to continue.

On the other side of ROCE, we have to consider valuation. That's why we have a FREE intrinsic value estimation for COKE on our platform that is definitely worth checking out.

High returns are a key ingredient to strong performance, so check out our free list ofstocks earning high returns on equity with solid balance sheets.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10