TransMedics Group (NasdaqGM:TMDX) Surges 20% Over Last Month

TransMedics Group (NasdaqGM:TMDX) experienced a 20% price increase over the last month. While the market has generally risen by about 5% in the past week and 4% over the past year, the company's performance stood out in comparison. With market earnings forecasted to grow by 14% annually, it suggests a favorable backdrop for growth-focused stocks. In this context, any significant company announcements or developments could have further supported the stock's positive momentum, further distinguishing it from the broader but still modest market uplift.

We've discovered 2 weaknesses for TransMedics Group that you should be aware of before investing here.

AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

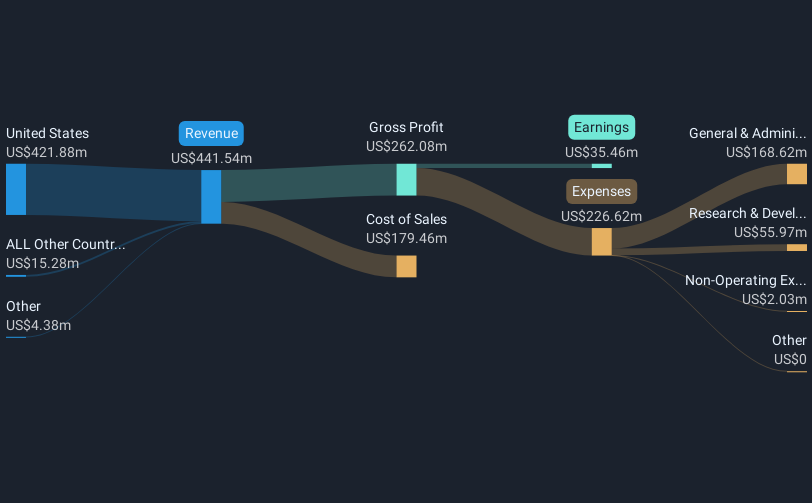

The recent surge in TransMedics Group's share price contrasts notably with its long-term total return of 386.01% over the past five years. While this uptick aligns with the broader growth-focused market backdrop, understanding the potential catalysts behind this movement is crucial. The company's long-term performance underscores its capacity to outpace industry growth. However, in the past year, TransMedics underperformed both the US Medical Equipment industry, which gained 0.9%, and the overall US market, which rose by 3.6%.

This latest price movement may influence future revenue and earnings forecasts, possibly affecting the value perception of TransMedics, especially with the launch of its Next-Gen Heart and Lung programs anticipated in late 2025. These developments could meaningfully drive transplant volumes and revenue, supporting bullish market sentiment. Additionally, the stock's current price of US$67.95 suggests room for appreciation relative to the consensus price target of US$102.86, representing a significant potential upside. Such optimism reflects expectations of continued growth in revenue and earnings, although actual outcomes will depend on successful execution of strategic plans and market conditions.

Examine TransMedics Group's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransMedics Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10