Textron Inc (TXT) Q1 2025 Earnings: EPS of $1.13 Beats Estimates, Revenue Hits $3.3 Billion

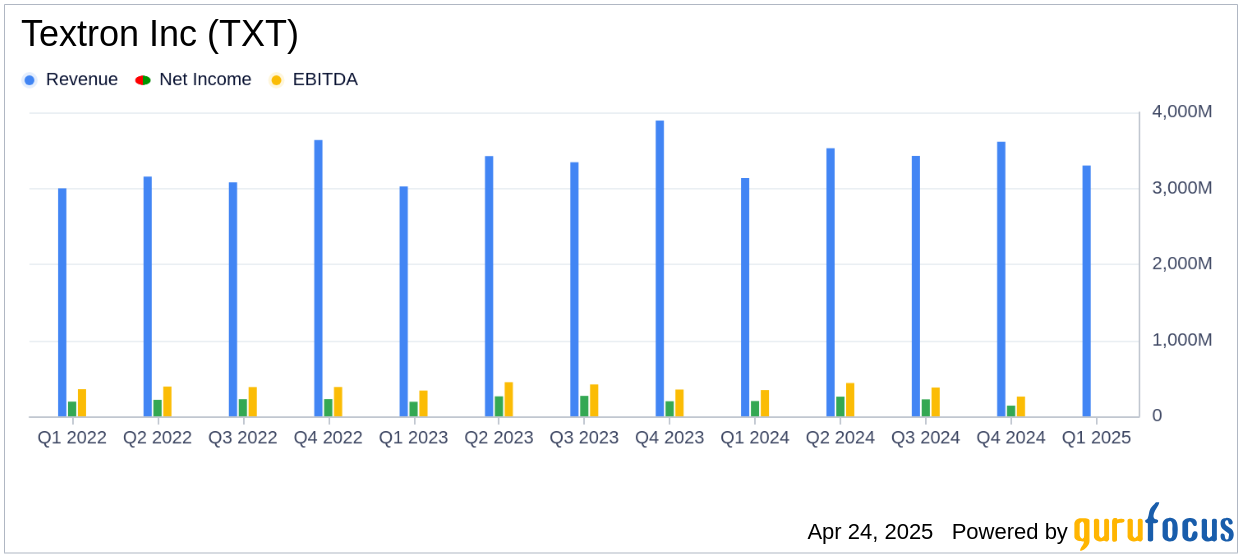

On April 24, 2025, Textron Inc (TXT, Financial) released its 8-K filing detailing its financial performance for the first quarter of 2025. The company reported earnings per share (EPS) of $1.13, surpassing the analyst estimate of $0.98. Adjusted EPS stood at $1.28, reflecting an increase from $1.20 in the prior year. Textron's revenues reached $3.3 billion, exceeding the estimated $3,249.48 million and marking a $171 million increase from the previous year.

Company Overview

Textron Inc (TXT, Financial) is a diversified conglomerate known for its design, manufacturing, and servicing of specialty aircraft, including small jets, helicopters, and tilt-rotor aircraft. The company operates through several segments: Textron Aviation, Bell, Textron Systems, Textron Industrial, and Textron eAviation. Textron Aviation is renowned for its Cessna and Beechcraft planes, while Bell focuses on helicopters and tilt-rotor aircraft for both commercial and military use. Textron Systems caters to the military market with uncrewed aircraft and armored vehicles, and Textron Industrial includes the Kautex business, which produces plastic fuel tanks and specialized vehicles.

Performance and Challenges

Textron Inc (TXT, Financial) demonstrated strong performance in the first quarter of 2025, with notable growth in both military and commercial product lines at Bell. The company's aviation operations showed improvement as production ramped up post-strike. However, challenges remain, particularly in the Industrial segment, where revenues declined due to lower volume and mix. The sale of the Powersports business, including the Arctic Cat brand, was completed, which may impact future revenue streams.

Financial Achievements

Textron Inc (TXT, Financial) achieved significant financial milestones, including returning $215 million to shareholders through share repurchases. The company's reaffirmation of its 2025 financial outlook, with expected GAAP earnings per share ranging from $5.19 to $5.39, underscores its confidence in sustained growth. In the Aerospace & Defense industry, such achievements are crucial as they reflect the company's ability to navigate market dynamics and maintain shareholder value.

Key Financial Metrics

Textron Inc (TXT, Financial) reported a net income of $207 million for the first quarter of 2025, up from $201 million in the same period last year. The company's balance sheet showed total assets of $16,942 million, with cash and equivalents at $1,194 million. Despite a net cash use of $114 million in operating activities, Textron's manufacturing cash flow before pension contributions was a negative $158 million, highlighting the impact of capital expenditures and inventory changes.

| Segment | Q1 2025 Revenue ($ million) | Q1 2024 Revenue ($ million) |

|---|---|---|

| Textron Aviation | 1,212 | 1,188 |

| Bell | 983 | 727 |

| Textron Systems | 296 | 306 |

| Industrial | 792 | 892 |

| Textron eAviation | 7 | 7 |

Analysis and Outlook

Textron Inc (TXT, Financial) has demonstrated resilience and adaptability in the face of industry challenges. The company's strategic divestitures and focus on core segments have positioned it well for future growth. The increase in Bell's military and commercial revenues, driven by programs like the U.S. Army's FLRAA, highlights Textron's strong market presence. However, the decline in Textron Systems and Industrial revenues indicates areas that require attention to sustain overall growth.

In the quarter, we saw strong growth in both military and commercial product lines at Bell," said Textron Chairman and CEO Scott C. Donnelly.

Textron Inc (TXT, Financial) remains committed to enhancing shareholder value through strategic initiatives and operational improvements. The company's reaffirmed financial outlook for 2025 reflects its confidence in achieving its goals despite the challenges in certain segments. As Textron continues to navigate the evolving Aerospace & Defense landscape, its focus on innovation and efficiency will be key to maintaining its competitive edge.

Explore the complete 8-K earnings release (here) from Textron Inc for further details.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10