What To Expect From Packaging Corporation of America’s (PKG) Q1 Earnings

Packaging Corporation of America (NYSE:PKG) will be reporting results tomorrow after market close. Here’s what to look for.

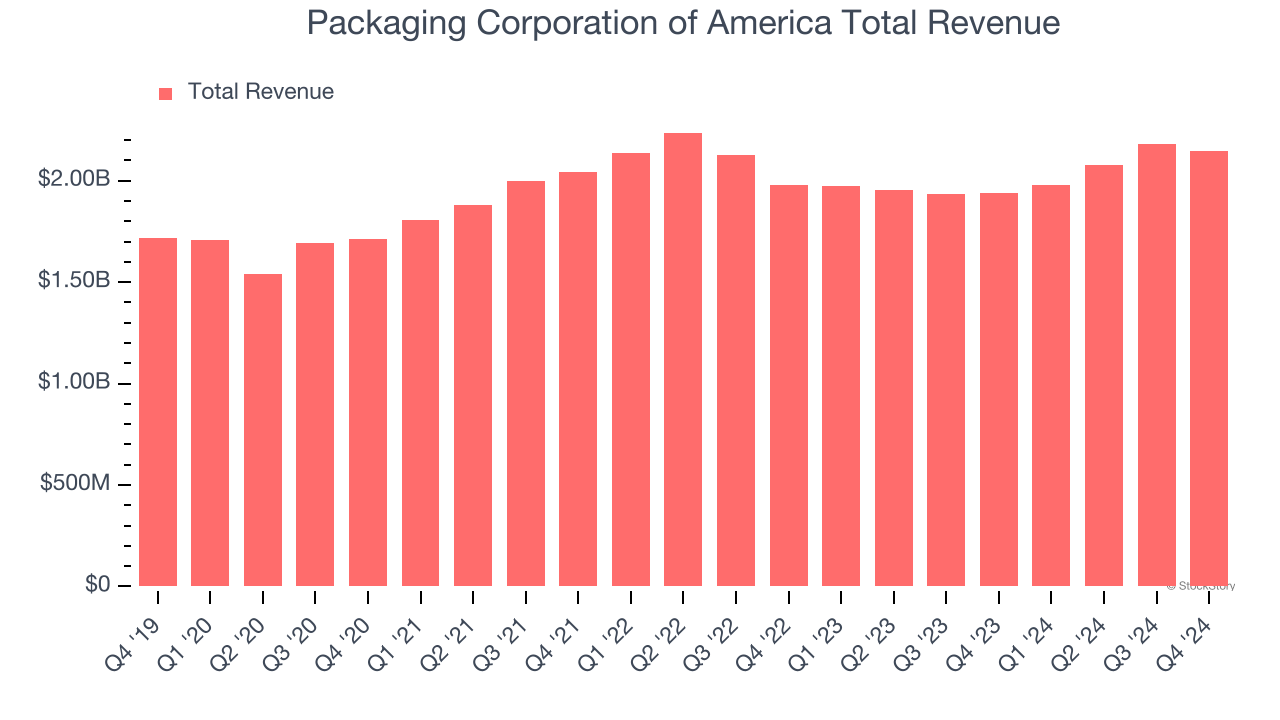

Packaging Corporation of America beat analysts’ revenue expectations by 0.6% last quarter, reporting revenues of $2.15 billion, up 10.7% year on year. It was a mixed quarter for the company, with a solid beat of analysts’ sales volume estimates but EPS guidance for next quarter missing analysts’ expectations.

Is Packaging Corporation of America a buy or sell going into earnings? Read our full analysis here, it’s free.

This quarter, analysts are expecting Packaging Corporation of America’s revenue to grow 6.5% year on year to $2.11 billion, improving from its flat revenue in the same quarter last year. Adjusted earnings are expected to come in at $2.21 per share.

Analysts covering the company have generally reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. Packaging Corporation of America has missed Wall Street’s revenue estimates three times over the last two years.

Looking at Packaging Corporation of America’s peers in the industrials segment, some have already reported their Q1 results, giving us a hint as to what we can expect. Lindsay delivered year-on-year revenue growth of 23.5%, beating analysts’ expectations by 4%, and Worthington reported a revenue decline of 3.9%, topping estimates by 6.7%. Lindsay traded down 8% following the results while Worthington was up 24%.

Read our full analysis of Lindsay’s results here and Worthington’s results here.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10