Bitcoin May Reach $2.4M by 2030, Says ARK Invest Report

ARK Invest has raised eyebrows again, this time with a bold call: Bitcoin could hit $2.4 million by the end of 2030. That’s up from its previous estimate of $1.5 million, thanks to what it sees as growing demand from institutions, national treasuries, and investors in emerging markets.

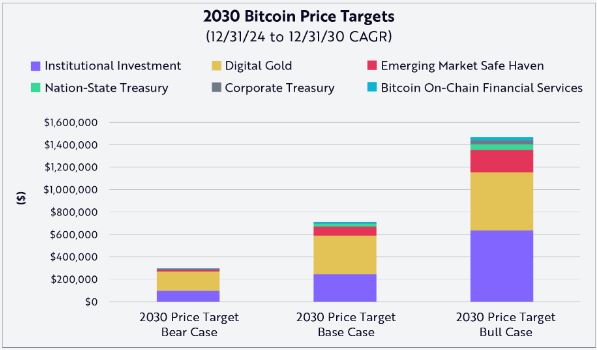

In its latest report, ARK outlines three possible scenarios for Bitcoin’s price. Even its most conservative case now puts Bitcoin at $500,000 — a big jump from the earlier $300,000 floor. The base case, which ARK sees as the most likely, stands at $1.2 million.

All these predictions are based on how much of the global financial market Bitcoin can capture in the years ahead.

We’ve published our bitcoin price forecast through 2030. Read our research from @dpuellARK and share your thoughts.https://t.co/CH7y5EyUjY

— ARK Invest (@ARKInvest) April 24, 2025

The team, led by analyst David Puell, believes the biggest driver will be institutional investors. If Bitcoin grabs even 6.5% of the $200 trillion global financial market (excluding gold), that alone could push it toward the $2.4 million mark.

Another major piece of the puzzle is Bitcoin’s growing reputation as “digital gold.” ARK estimates that by 2030, Bitcoin could capture up to 60% of gold’s $18 trillion market cap. That would add significantly to its value.

Emerging markets also play a key role in ARK’s vision. In countries where currencies are unstable and inflation runs high, Bitcoin is increasingly being seen as a safer way to hold value. ARK says this use case could make up about 13.5% of Bitcoin’s potential price in their most optimistic scenario.

Beyond that, ARK also looked at nation-states and corporations holding Bitcoin as part of their reserves. In addition to that, the growing ecosystem of Bitcoin-based financial services, like Layer 2 networks and tokenized versions of Bitcoin (like WBTC) — has made the picture even more bullish.

What’s interesting is that ARK didn’t just look at total supply. They adjusted for “active” Bitcoin, removing coins that are lost or haven’t moved in years. Based on that more realistic supply number, they believe the $2.4 million price tag actually makes more sense than it seems on the surface.

If Bitcoin really were to hit $2.4 million, it would mean a total market cap of about $49 trillion — nearly the size of the combined GDP of the U.S. and China today. It would also make Bitcoin the most valuable asset in the world, even ahead of gold.

Of course, even ARK’s lower-end targets require serious growth. The $500,000 bear case would mean an annual return of 32% from now until 2030. The base case of $1.2 million implies a 53% yearly gain. That kind of growth is rare for any asset — especially one that’s already worth over a trillion dollars.

Still, the timing of this updated forecast is notable. Bitcoin recently bounced back from a low of around $75,000 earlier this year and is now trading near $94,000. On top of that, the U.S. has just created a Strategic Bitcoin Reserve under the Trump administration — another sign that Bitcoin is being taken more seriously at the highest levels.

In short, ARK is betting big on Bitcoin’s future. Whether it hits $2.4 million or not, the takeaway is clear: Wall Street and beyond are starting to treat Bitcoin as more than just a bet — they’re treating it as a foundation for the future of finance.

Also Read: ARK Invest Takes First Direct Stake in Solana via ETF

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10