Camping World (CWH) Reports Q1: Everything You Need To Know Ahead Of Earnings

Recreational vehicle (RV) and boat retailer Camping World (NYSE:CWH) will be reporting results tomorrow after the bell. Here’s what investors should know.

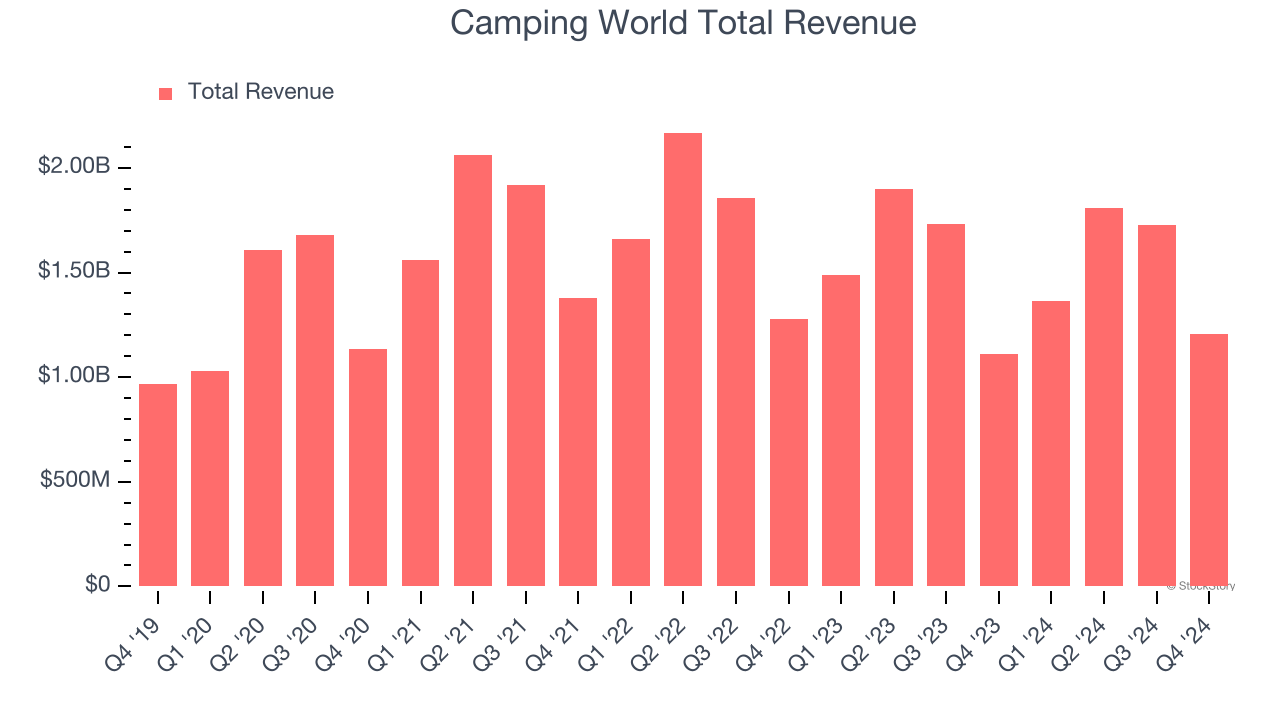

Camping World beat analysts’ revenue expectations by 6.6% last quarter, reporting revenues of $1.20 billion, up 8.6% year on year. It was a stunning quarter for the company, with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ gross margin estimates.

Is Camping World a buy or sell going into earnings? Read our full analysis here, it’s free.

This quarter, analysts are expecting Camping World’s revenue to grow 4.7% year on year to $1.43 billion, a reversal from the 8.3% decrease it recorded in the same quarter last year. Adjusted loss is expected to come in at -$0.20 per share.

Analysts covering the company have generally reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. Camping World has missed Wall Street’s revenue estimates five times over the last two years.

Looking at Camping World’s peers in the automotive and marine retail segment, some have already reported their Q1 results, giving us a hint as to what we can expect. Lithia delivered year-on-year revenue growth of 7.2%, missing analysts’ expectations by 2.1%, and CarMax reported revenues up 6.7%, in line with consensus estimates. Lithia traded down 1.4% following the results while CarMax was also down 14.7%.

Read our full analysis of Lithia’s results here and CarMax’s results here.

Debates around the economy’s health and the impact of potential tariffs and corporate tax cuts have caused much uncertainty in 2025. While some of the automotive and marine retail stocks have shown solid performance in this choppy environment, the group has generally underperformed, with share prices down 3% on average over the last month. Camping World is down 14.1% during the same time and is heading into earnings with an average analyst price target of $24.25 (compared to the current share price of $13.88).

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10