Bitcoin dips below $94,000 as ETFs record $3b weekly inflow 2 minutes ago

U.S. Bitcoin spot ETFs have recorded $3.06 billion in net inflows for the week ending April 25, 2025, their strongest weekly performance since November 2024.

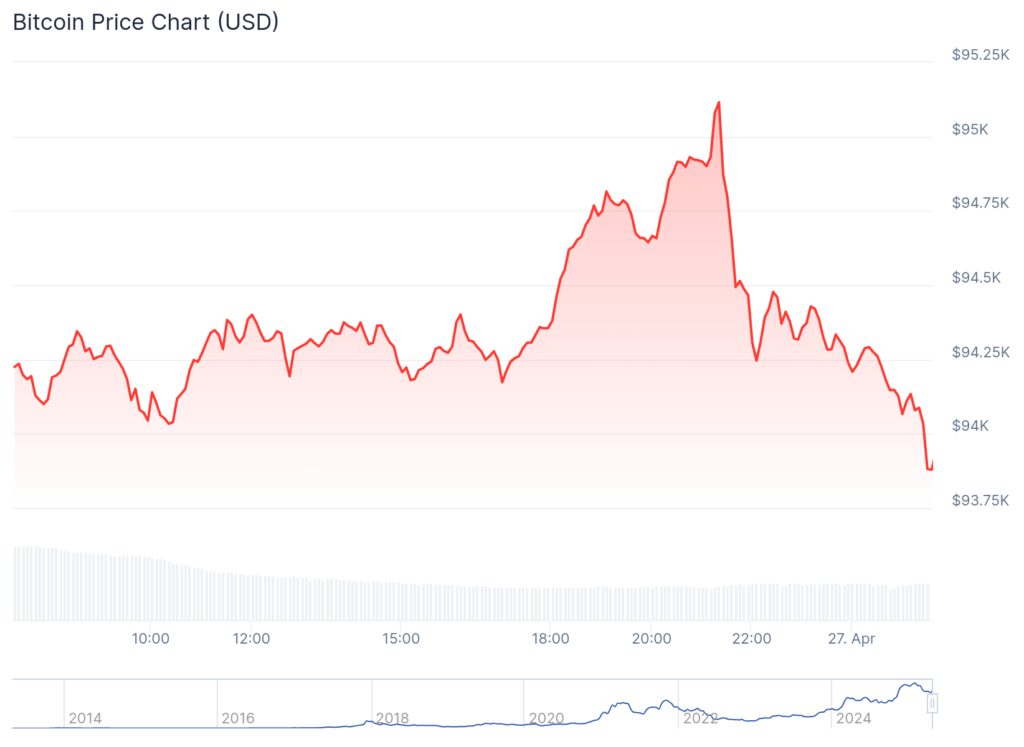

This capital inflow coincides with Bitcoin (BTC), which dipped below $94,000 on Sunday and is currently in the red. See below.

The combined ETF products now hold $109.27 billion in total net assets and account for approximately 5.8% of Bitcoin’s total market capitalization, according to data from SoSoValue.

BlackRock leads Bitcoin ETF inflow

The latest Bitcoin ETF data reveals a strong rebound in investor interest after several weeks of mixed performance. Daily inflows on April 25 reached $379.99 million, contributing to the weekly total of $3.06 billion.

For context, the week ending April 11 recorded $713.30 million in net outflows, followed by a modest $15.85 million inflow the week ending April 17.

BlackRock’s IBIT leads with $240.15 million in daily inflows and maintains its position as the largest Bitcoin ETF with $56.03 billion in assets under management. The fund has accumulated $41.20 billion in cumulative net inflows since its launch.

Fidelity’s FBTC secured the second position with $108.04 million in daily inflows and $19.12 billion in total net assets. Other notable performers include ARKB (ARK 21Shares) with $11.39 million in daily inflows and Grayscale’s BTC with $19.87 million. However, its converted flagship GBTC product continues to experience outflows, with $7.53 million leaving the fund on April 25.

Trading activity has also increased substantially, with $18.76 billion in total value traded for the week, compared to $7.15 billion the previous week. The cumulative total net inflow across all Bitcoin spot ETFs now stands at $38.43 billion since their launch.

Despite Grayscale’s GBTC experiencing cumulative outflows of $22.69 billion since its conversion from a trust structure, the overall ETF ecosystem continues to bring in considerable new capital.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10