Have $100,000? Here Are 2 Ways to Grow That Money Into $1 Million for Retirement Savings

-

Saving $100,000 to invest is not easy.

-

But once you reach this level, you can really start to accumulate wealth.

-

There are several strategies that have been proven historically to grow $100,000 into $1 million over time.

The great Charlie Munger, who died in 2023 and formerly served as Berkshire Hathaway's vice chairman, always gave blunt financial advice to investors seeking his wisdom.

One key piece of advice was to find a way to save $100,000 to invest. "The first $100,000 is a b****, but you gotta do it," he once said during one of Berkshire's annual shareholder meetings in the 1990s. "I don't care what you have to do... If it means walking everywhere and not eating anything that wasn't purchased with a coupon, find a way to get your hands on $100,000."

Munger's main reason for obtaining $100,000 is due to the power of compounding and how it can turn a sum of money into a much greater sum over time. So, if you've completed this monumental achievement and managed to save $100,000 to invest, here are two ways to turn it into $1 million.

Set it and forget it

Munger and his pal Warren Buffett agreed that you don't have to be a genius to get rich if you have time on your side. In fact, Buffett often attributes his wealth to the fact that he's had many decades to invest. The earlier one starts investing, the better because returns compound and build off each other.

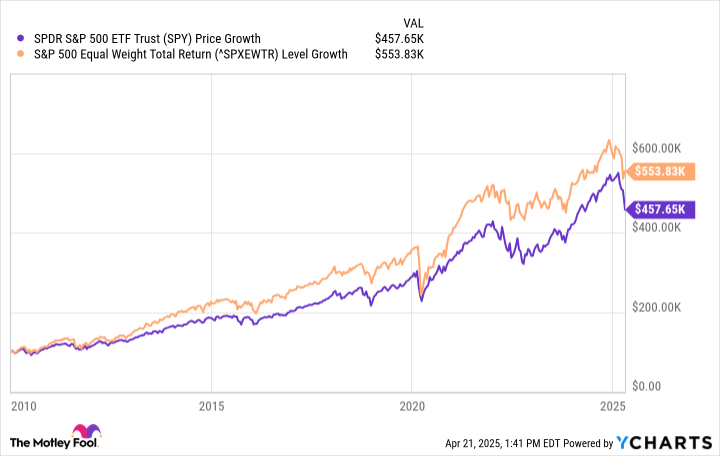

Now, obviously, it all depends on where you are in your life. Investors closing in on retirement may not have the same luxury as those with a full career ahead of them, and those early on in their careers may find it difficult to save $100,000 so young. But if you were able to invest $100,000 in the broader benchmark S&P 500 or the S&P 500 Equal Weight Index over the last 30 years, you would now be a millionaire.

SPY data by YCharts

While the S&P 500 has long been deemed a safe and diverse place to put money for the long term, investors today may want to consider the equal-weighted index, especially if they don't have 30 years to invest, because the S&P 500 has become so concentrated with large tech and artificial intelligence names. Many of these stocks have done well, but it makes the index less diverse than it once was. If you didn't have 30 years to invest but only 15, you might not be a millionaire but you would still have significantly increased your wealth had you invested in these two indexes.

SPY data by YCharts

Let dividends pay you passive income

Another investing strategy is to invest in strong dividend stocks that send shareholders money every quarter and sometimes every month. While dividends aren't guaranteed and depend on the financial health of the company paying the dividend, there are companies out there that have paid and increased their dividends for decades while also seeing their share prices appreciate as well.

Let's say you were to invest $100,000 into a stock or a handful of stocks and realize a collective annual dividend yield of 3%. If we also assume a quarterly payout, a 15% tax rate, a 6% annual dividend increase, and share price appreciation, your investment would surpass $1 million over 30 years.

Now, there are certainly higher dividend yields you can invest in, but often, an ultra-high yield can be a warning sign that the stock is at risk or the company is not financially stable. Dividend investors can look at several key metrics to determine the safety of a dividend and the potential to grow it. One is the dividend payout ratio, which looks at a dividend as a percentage of earnings. If this ratio is less than 100% of earnings, that means the company is generating enough profit each year to cover its dividend.

Another good one is free cash flow yield, in which you divide free cash flow (FCF), which is net cash from operations minus capital expenditures, by market cap or take FCF per share and divide it by the company's share price. If the FCF yield is higher than the company's dividend yield, that means it can pay the dividend from FCF generation.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10