Union Pacific Analysts Cut Their Forecasts After Downbeat Results

Union Pacific Corporation (NYSE:UNP) reported worse-than-expected first-quarter 2025 results on Thursday.

Union Pacific reported operating revenue of $6.027 billion, flat year-over-year, missing the consensus of $6.08 billion. Freight revenue was $5.691 billion, with Bulk up 1 % year over year, Industrial down 1%, and Premium up 5%. Revenue carloads were up 7%.

Earnings per share were $2.70 compared to $2.69 a year ago, below the consensus of $2.75.

“The team delivered a solid start to the year as we worked closely with our customers to meet their needs in an uncertain environment. Looking to the rest of 2025, we will continue to execute our strategy that emphasizes safety, service, and operational excellence. Building on a strong foundation with our record First Quarter operating performance, we are positioned to deliver,” commented Jim Vena, Union Pacific's Chief Executive Officer.

Union Pacific shares fell 1.4% to trade at $212.39 on Friday.

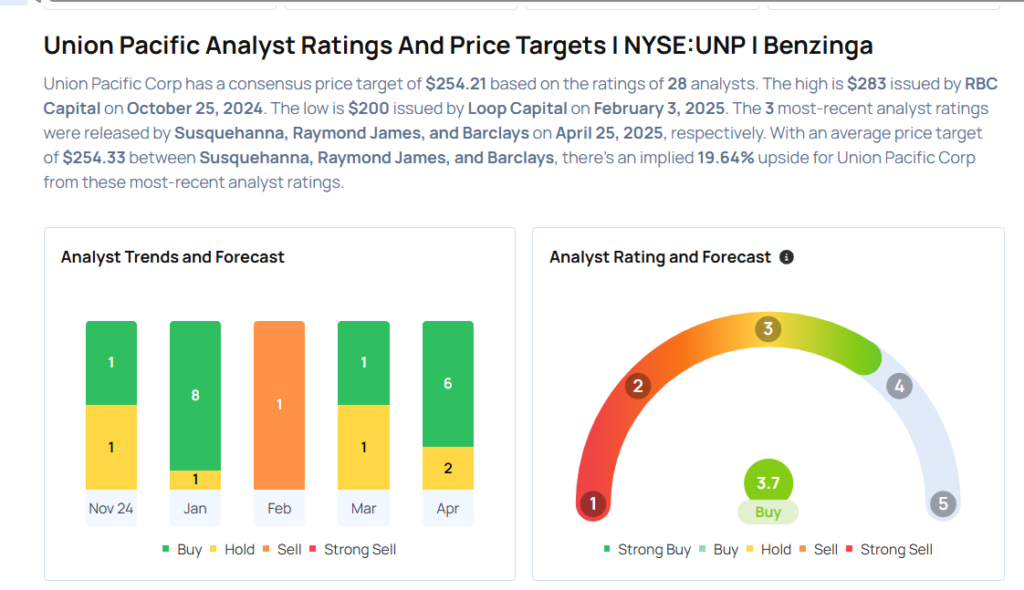

These analysts made changes to their price targets on Union Pacific following earnings announcement.

- Barclays analyst Brandon Oglenski maintained Union Pacific with an Overweight rating and lowered the price target from $285 to $260.

- Raymond James analyst Patrick Tyler Brown maintained the stock with a Strong Buy and cut the price target from $260 to $258.

- Susquehanna analyst Bascome Majors maintained Union Pacific with a Neutral rating and lowered the price target from $255 to $245.

Considering buying UNP stock? Here’s what analysts think:

Read This Next:

- Jim Cramer: OneMain Is ‘Too Risky,’ Recommends Buying Reddit

Photo via Shutterstock

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10