Westinghouse Air Brake Technologies Corporation (NYSE:WAB) reported better-than-expected first-quarter adjusted EPS results and raised its FY25 adjusted EPS guidance on Wednesday.

Westinghouse Air Brake reported quarterly earnings of $2.28 per share which beat the analyst consensus estimate of $2.03 per share. The company reported quarterly sales of $2.61 billion which met the analyst consensus estimate.

“The Wabtec team has started the year strong, delivering over 20% in earnings per share growth and highlighting the continued business momentum across both the Freight and Transit segments,” said Rafael Santana, Wabtec’s President and CEO.

Westinghouse Air Brake raised its FY2025 adjusted EPS guidance from $8.35-$8.75 to $8.35-$8.95.

Westinghouse Air Brake shares gained 1.8% to trade at $185.32 on Thursday.

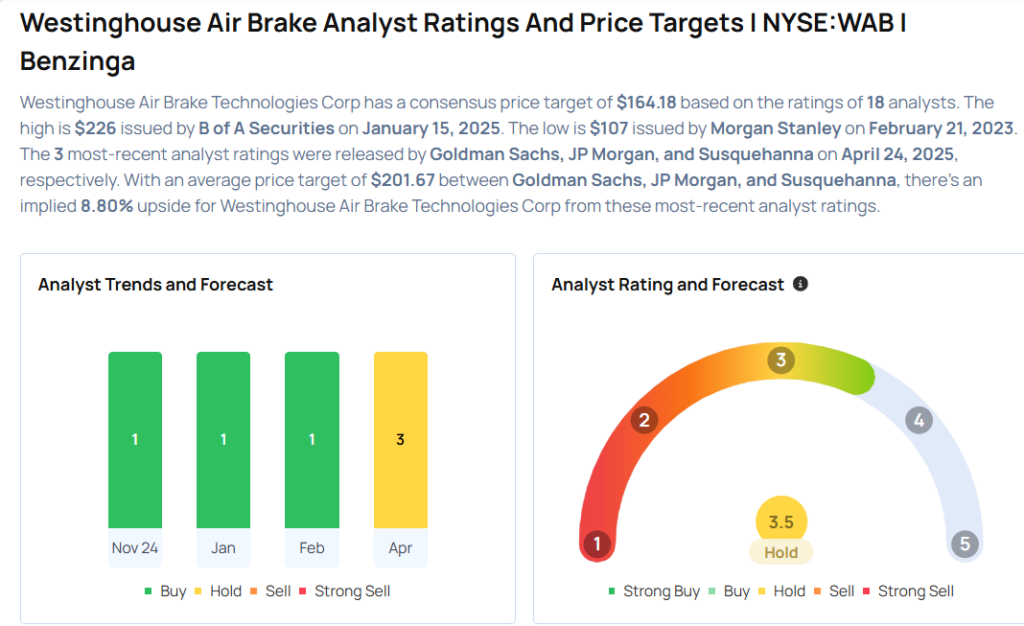

These analysts made changes to their price targets on Westinghouse Air Brake following earnings announcement.

- Susquehanna analyst Bascome Majors maintained Westinghouse Air Brake with a Positive rating and lowered the price target from $218 to $210.

- JP Morgan analyst Tami Zakaria maintained the stock with a Neutral and raised the price target from $175 to $194.

- Goldman Sachs analyst Jerry Revich maintained Westinghouse Air Brake with a Neutral and raised the price target from $175 to $201.

Considering buying WAB stock? Here’s what analysts think:

Read This Next:

- Top 2 Consumer Stocks That May Implode This Month

Photo via Shutterstock