These Analysts Boost Their Forecasts On American Tower Following Q1 Upbeat Results

American Tower Corp (NYSE:AMT) reported better-than-expected first-quarter financial results on Tuesday.

American Tower reported first-quarter revenue of $2.56 billion, beating analyst estimates of $2.54 billion, according to estimates from Benzinga Pro. The company also reported adjusted funds from operations (AFFO) of $2.75 per share, beating estimates of $2.58 per share.

"Together with the resilient demand we're seeing for our portfolio of assets, we remain focused on enhancing the quality of our earnings through active portfolio management, organizational and operational efficiency, disciplined capital allocation and a strong balance sheet, positioning us to better navigate ongoing macroeconomic uncertainty while continuing to meet our customers' critical connectivity needs," said Steven Vondran, CEO of American Tower.

American Tower said it expects total property revenue in 2025 to be between $9.97 billion and $10.12 billion. The company also raised its full-year AFFO guidance from a range of $10.31 to $10.50 to a new range of $10.35 to $10.54 per share, versus estimates of $10.39 per share.

American Tower shares gained 4.8% to close at $221.33 on Tuesday.

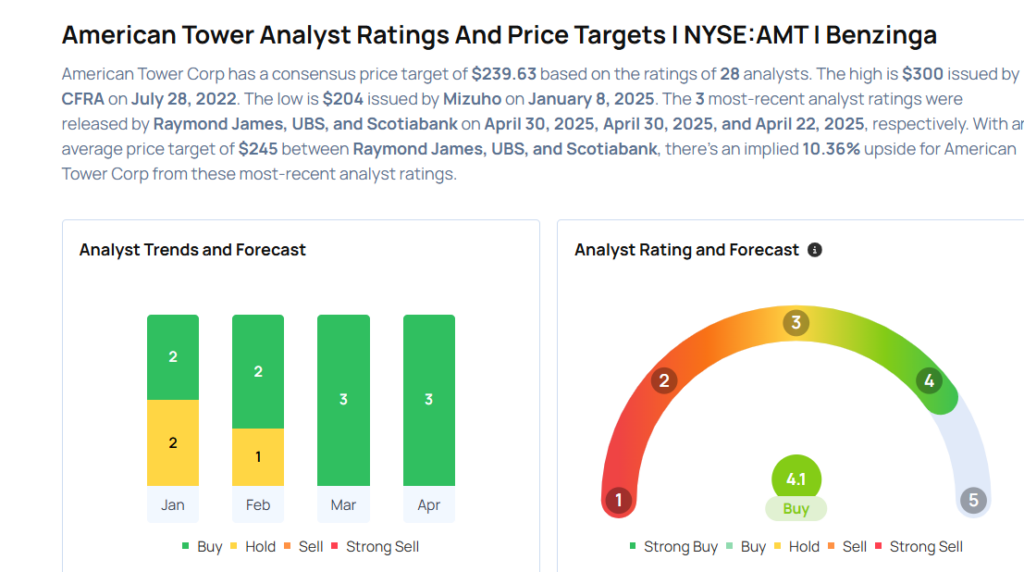

These analysts made changes to their price targets on American Tower following earnings announcement.

- UBS analyst Batya Levi maintained American Tower with a Buy rating and raised the price target from $245 to $250.

- Raymond James analyst Ric Prentiss maintained American Tower with a Strong Buy rating and raised the price target from $231 to $251.

Considering buying AMT stock? Here’s what analysts think:

Read This Next:

- Top 3 Industrials Stocks Which Could Rescue Your Portfolio In Q2

Photo via Shutterstock

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10