Bitcoin miners may find better returns in AI than crypto, Novogratz’s Galaxy Digital suggests 6 seconds ago

Bitcoin miners with the right infrastructure and management talent can gain substantial value by pivoting into the booming AI and HPC data center market, analysts say.

As demand for AI infrastructure grows, crypto miners with access to power and cooling could be well positioned to profit from supporting high-performance computing workloads, according to a Galaxy Digital research report.

The analysts believe miners with experienced management teams capable of executing AI and HPC buildouts have a “tremendous opportunity” to bring “significant incremental value to their companies.” The appeal lies in the long-term contracts and strong, steady cash flow models of AI and HPC colocation — described by Galaxy Digital as “predictable and high margin cash flow streams” — a level of stability that’s often lacking in crypto markets.

“Not only is revenue more predictable than Bitcoin mining, it’s also uncorrelated to crypto markets, which smooths revenue profiles of companies with high exposure to the volatile crypto markets. In Bitcoin bear markets, this can enhance financial stability, allowing miners to continue to raise cash through equity or debt without incurring excessive dilution or interest burden.”

Galaxy Digital

Financing options are also expanding. Data center operators that have a lease in hand with a credit worthy counterparty “can take that lease and raise substantial sums of project financing to construct the data center,” Galaxy wrote, citing $18 billion in development financing underwritten in Q1 2024 alone.

The valuation gap is another key factor, with the report noting that Bitcoin (BTC) miners have typically traded at six to 12 times their earnings, while some of the world’s largest data center operators are valued at 20 to 25 times earnings.

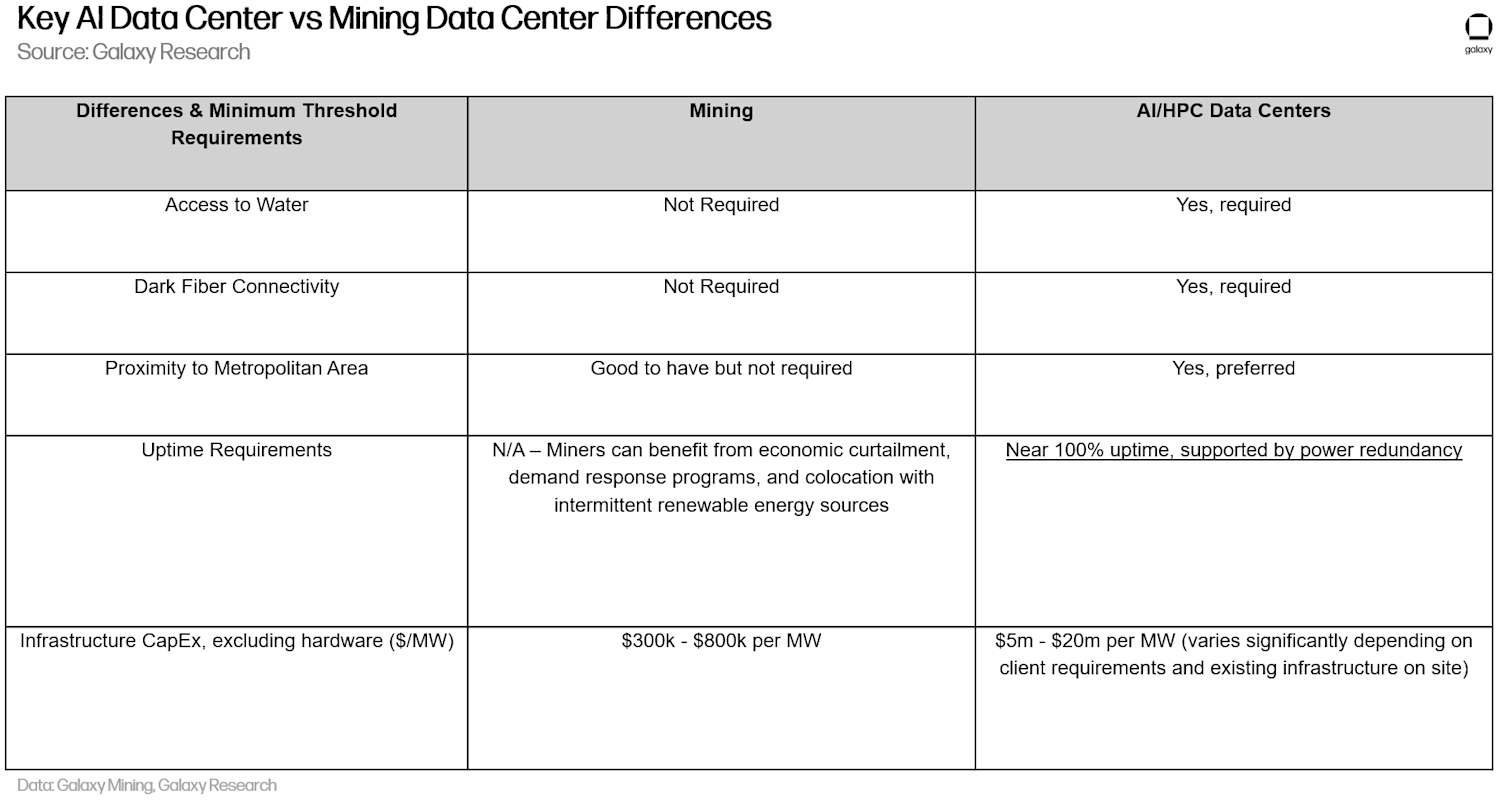

However, not all crypto mining sites are fit for the shift, Mike Novogratz’s Galaxy Digital wrote, noting that some may not have the right conditions for AI and high-performance computing, even if they still work well for Bitcoin mining.

With U.S. data center capacity expected to more than double by 2030, Galaxy says miners who adapt now could become “some of the largest operators in the industry.”

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10