Aon plc (NYSE:AON) reported downbeat earnings for its first quarter on Friday.

The company posted quarterly earnings of $5.67 per share which missed the analyst consensus estimate of $6.02 per share. The company reported quarterly sales of $4.73 billion which missed the analyst consensus estimate of $4.86 billion.

“Aon has momentum entering year two of the 3×3 Plan and our continued execution drove another quarter of mid-single-digit Organic revenue growth and strong operating performance,” said Greg Case, president and CEO of Aon. “In the first quarter, we delivered 5% Organic revenue growth, 12% Adjusted Operating Income growth and Adjusted EPS of $5.67. We are driving growth by providing actionable insights, powered by Aon Business Services, to our clients in an increasingly complex macro environment. These results reflect robust demand for our Risk Capital and Human Capital solutions. We are reaffirming our 2025 guidance, across all key metrics, reflecting the resilience and strength of our business and financial model.”

Aon shares rose 1.4% to trade at $340.52 on Monday.

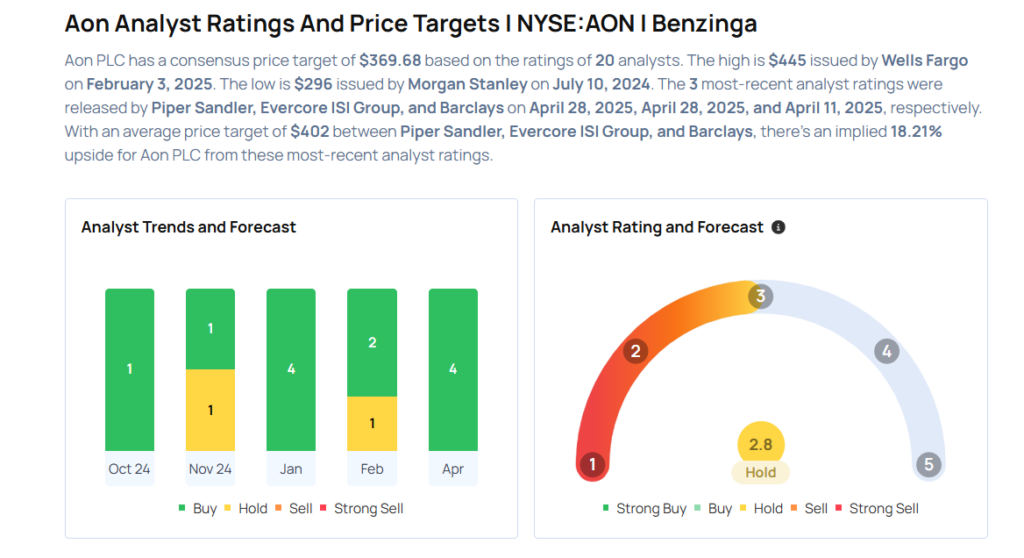

These analysts made changes to their price targets on Aon following earnings announcement.

- Evercore ISI Group analyst David Motemaden maintained Aon with an Outperform rating and lowered the price target from $420 to $398.

- Piper Sandler analyst Paul Newsome upgraded Aon from Neutral to Overweight and lowered the price target from $384 to $378.

Considering buying AON stock? Here’s what analysts think:

Read This Next:

- Top 2 Industrials Stocks That May Fall Off A Cliff This Quarter

Photo via Shutterstock