Roper Technologies, Inc (NASDAQ:ROP) reported better-than-expected earnings for its first quarter and raised its forecast on Monday.

The company posted first-quarter adjusted earnings per share of $4.78, beating the street view of $4.74. Quarterly sales of $1.88 billion outpaced the analyst consensus estimate of $1.82 billion.

“Roper had a strong start to 2025 and our enterprise continues to execute at a high level,” said Neil Hunn, Roper’s President and CEO. “Our total revenue growth of 12% was driven by an 8% acquisition contribution and 5% organic growth. Importantly, our trailing-twelve-months free cash flow grew 12% with a 31% free cash flow margin. Last week, we completed the acquisition of CentralReach, a leading provider of cloud-native software enabling the workflow and administration of Applied Behavior Analysis therapy. CentralReach is a terrific business that not only meets each of our historical acquisition criteria but also meets our higher growth and higher return expectations.”

Roper Technologies expects fiscal 2025 adjusted earnings per share of $19.80-$20.05 (compared to a previous outlook of $19.75-$20.00), versus the $19.92 estimate. It increased its full-year total revenue growth outlook to ~12% or $7.88 billion (compared to a previous outlook of 10%+ or $7.74 billion) and an analyst estimate of $7.74 billion. It reiterated organic revenue growth of +6-7%.

Roper Technologies shares fell 1% to close at $551.95 on Monday.

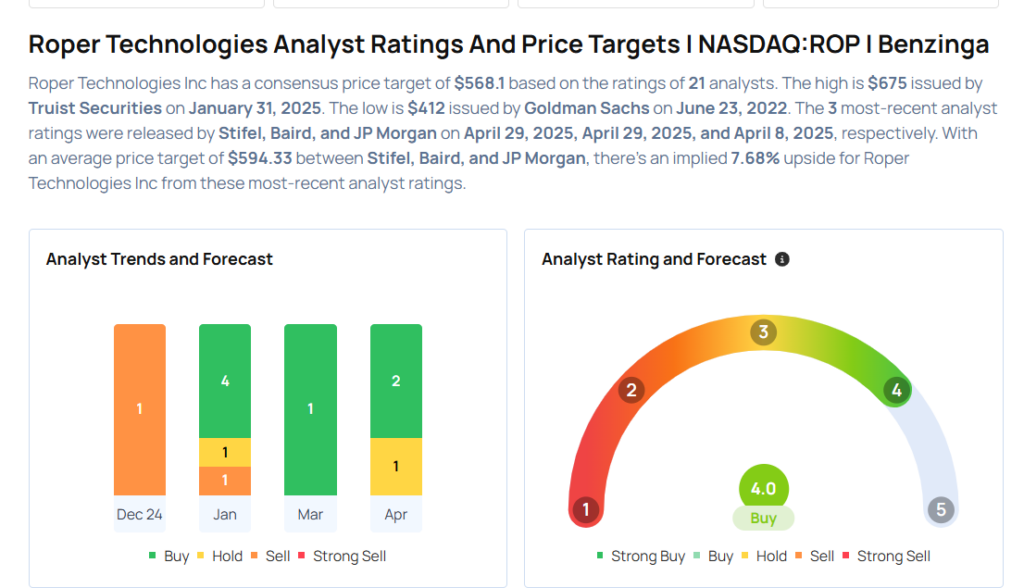

These analysts made changes to their price targets on Roper Technologies following earnings announcement.

- Baird analyst Joe Vruwink maintained Roper Technologies with an Outperform rating and raised the price target from $660 to $668.

- Stifel analyst Brad Reback maintained the stock with a Buy rating and lowered the price target from $685 to $650.

Considering buying ROP stock? Here’s what analysts think:

Read This Next:

- General Motors, Coca-Cola And 3 Stocks To Watch Heading Into Tuesday

Photo via Shutterstock