Fair Isaac Corp (FICO) Q2 Earnings: EPS of $6.59 Beats Estimates, Revenue Slightly Misses at $498.7 Million

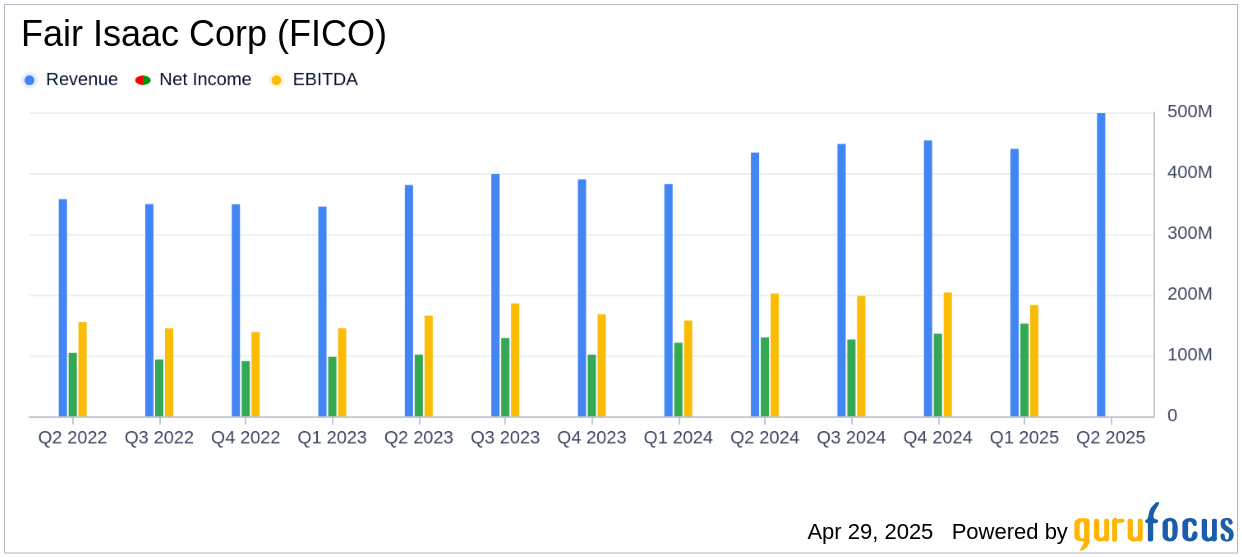

On April 29, 2025, Fair Isaac Corp (FICO, Financial) released its 8-K filing for the second fiscal quarter ended March 31, 2025. The company, renowned for its FICO credit scores, reported earnings per share (EPS) of $6.59, surpassing the analyst estimate of $6.34. Revenue for the quarter reached $498.7 million, slightly below the estimated $499.79 million but marking a significant increase from the previous year's $434 million.

Company Overview

Founded in 1956, Fair Isaac Corporation is a leader in applied analytics, primarily known for its FICO credit scores, a benchmark for assessing consumer creditworthiness. The company's credit scores business, which includes both business-to-business and business-to-consumer services, is a major profit driver. Additionally, Fair Isaac provides software solutions to financial institutions for analytics, decision-making, customer workflows, and fraud prevention.

Performance and Challenges

Fair Isaac Corp's performance in the second quarter of fiscal 2025 was marked by a 15% increase in revenue compared to the prior year. This growth was driven by a 25% increase in scores revenue, with business-to-business scoring solutions seeing a 31% rise. However, software revenue growth was modest at 2%, primarily due to increased license revenue recognized at a point in time. The company's ability to maintain this growth trajectory is crucial, as it faces challenges such as competition and regulatory changes in the use of consumer credit data.

Financial Achievements

The company's financial achievements are noteworthy, with net income for the quarter totaling $162.6 million, up from $129.8 million in the prior year. Non-GAAP net income was $192.7 million, compared to $154.5 million in the previous year. These achievements underscore Fair Isaac's strong position in the software industry, where profitability and revenue growth are key indicators of success.

Key Financial Metrics

Fair Isaac Corp's income statement reveals total revenues of $498.7 million for the quarter, with operating income reaching $245.6 million. The balance sheet shows total assets of $1.84 billion, with a significant portion in accounts receivable and goodwill. The company's cash flow statement highlights net cash provided by operating activities of $74.9 million, reflecting strong operational efficiency.

| Metric | Q2 2025 | Q2 2024 |

|---|---|---|

| Revenue | $498.7 million | $433.8 million |

| Net Income | $162.6 million | $129.8 million |

| EPS | $6.59 | $5.16 |

Analysis and Outlook

Fair Isaac Corp's robust performance in the second quarter is a testament to its strategic focus on expanding its scoring solutions and maintaining a strong foothold in the software industry. The company's reiteration of its fiscal year 2025 guidance, which includes double-digit growth in both revenue and earnings, reflects confidence in its ongoing strategies. However, the company must navigate challenges such as maintaining competitive advantage and adapting to regulatory changes to sustain its growth momentum.

“In our second fiscal quarter, we again delivered strong results with revenue growth of 15%, and even stronger earnings growth,” said Will Lansing, chief executive officer.

Overall, Fair Isaac Corp's second-quarter results demonstrate its resilience and strategic acumen in a competitive industry, making it a company to watch for value investors seeking growth opportunities in the software sector.

Explore the complete 8-K earnings release (here) from Fair Isaac Corp for further details.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10