Upstart Holdings to Report Q1 Earnings: How to Play the Stock?

Upstart Holdings UPST is slated to report first-quarter 2025 results on May 6, after market close.

The company expects revenues of approximately $200 million for the quarter. The Zacks Consensus Estimate is currently pegged at $200.7 million, suggesting an improvement of 57.1% year over year.

The consensus mark for earnings is pegged at 19 cents per share, indicating a robust turnaround from the year-ago quarter’s loss of 31 cents per share. The consensus mark for the bottom line has remained unchanged over the past 60 days.

Image Source: Zacks Investment Research

UPST’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 188%. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Upstart Holdings, Inc. Price and EPS Surprise

Upstart Holdings, Inc. price-eps-surprise | Upstart Holdings, Inc. Quote

Earnings Whispers for Upstart

Our proven model does not conclusively predict an earnings beat for Upstart this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here. You can see the complete list of today’s Zacks #1 Rank stocks here.

Though UPST carries a Zacks Rank #3, it has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Factors Likely to Influence Upstart’s Q1 Results

Upstart’s first-quarter performance is likely to have gained from its strategy to operate as a multiproduct company. Innovative product launches like the Upstart Macro Index and features like Parallel Timing Curve Calibration and Recognized Customer Personalization to promote improved data-driven decisions among lenders are likely to have favored the company’s performance.

UPST’s expertise in offering unsecured loans, especially when traditional banks are cautious amid the ongoing macroeconomic uncertainties, is likely to have contributed to its customer base growth. The Federal Reserve’s three rate cuts in 2024 are likely to have benefited the company’s first-quarter performance.

Upstart’s ongoing efforts to automate the unsecured loan process might have contributed positively to the to-be-reported quarter. It is also expected to have gained from multiple partnerships with banks and credit unions.

Amid the ongoing macroeconomic headwinds, Upstart is cutting costs by reducing its workforce. This measure is likely to have aided UPST in counterbalancing the protracted high inflationary conditions that are negatively impacting transaction volume growth on the Upstart platform.

However, headwinds from the weakening lending market due to elevated consumer risk caused by multiple bank failures and the dislocation of capital markets might have affected Upstart’s revenues in the first quarter. The volatility in the macro environment, caused by macroeconomic uncertainties and geopolitical tension, is also expected to have hurt UPST’s performance.

Upstart’s Price Performance & Valuation

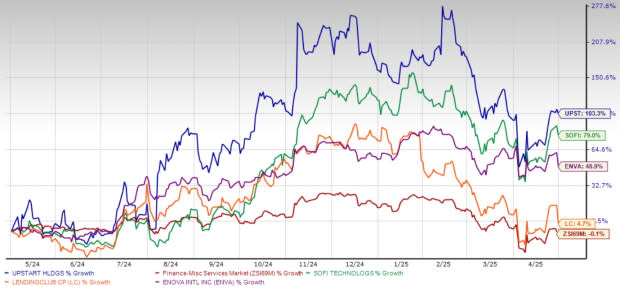

Upstart shares have surged 103.4% over the past year, outperforming the Zacks Financial – Miscellaneous Services industry’s decline of 0.1%.

Compared with other traditional lenders, Upstart stock has outperformed SoFi Technologies SOFI, Enova International ENVA and LendingClub LC. Shares of SoFi Technologies, Enova International and LendingClub have risen 79%, 48.9% and 4.7%, respectively.

One-Year Price Return Performance

Image Source: Zacks Investment Research

Let us now look at the value Upstart offers to its investors at current levels. UPST is currently trading at a premium with a forward 12-month price-to-sales (P/S) of 4.09X compared with the industry’s 3.3X, indicating a stretched valuation.

Image Source: Zacks Investment Research

Its competitors, SoFi Technologies, LendingClub and Enova International, have a forward 12-month P/S of 4.02X, 1.14X and 0.74X, respectively.

Investment Thesis for Upstart Stock

Upstart’s business model thrives in a low-interest-rate environment. By using AI to assess borrower creditworthiness, the company provides faster loan approvals, making it an attractive alternative to traditional lenders.

The Federal Reserve’s three rate cuts in 2024 have already fueled a recovery for Upstart, reversing some of the damage from previous rate hikes that had cut its annual revenue run rate in half. With more cuts expected in 2025, borrowing costs should decline further, stimulating loan demand and revenue growth.

The company has also made strides in diversifying its funding sources and securing institutional partnerships that reduce its dependency on holding loans on its balance sheet. Upstart's innovations in personal and auto loan segments, combined with its strategic investments in new loan products, hold promise for future growth.

Conclusion: Hold Upstart Stock for Now

Upstart Holdings’ AI-powered innovation, improving macro backdrop and expanding loan offerings position it well for future growth. However, its high valuation makes it vulnerable to short-term volatility. For now, holding the stock is the smartest approach.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

LendingClub Corporation (LC) : Free Stock Analysis Report

Enova International, Inc. (ENVA) : Free Stock Analysis Report

Upstart Holdings, Inc. (UPST) : Free Stock Analysis Report

SoFi Technologies, Inc. (SOFI) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10