Ansys Inc Q1 2025 Earnings: Non-GAAP EPS of $1.64 Surpasses Estimates, Revenue of $504.9 Million Misses Expectations

On April 30, 2025, Ansys Inc (ANSS, Financial) released its 8-K filing detailing its financial results for the first quarter of 2025. Ansys, a leading engineering software company, provides simulation capabilities across various domains, serving over 50,000 customers globally with a workforce of more than 4,000 employees.

Performance Overview

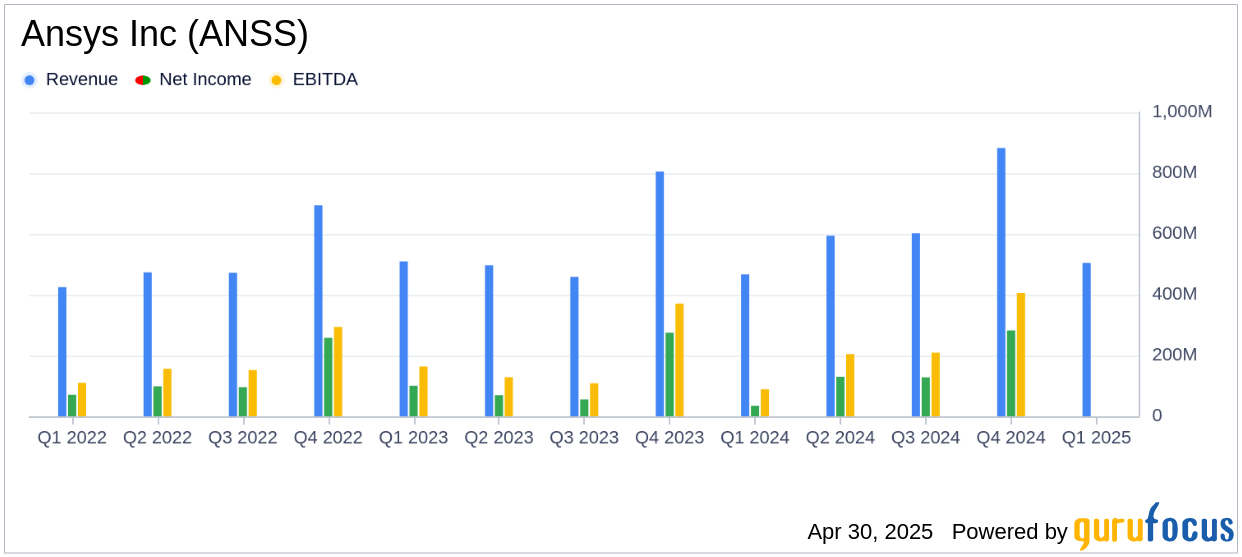

Ansys Inc reported a Q1 2025 revenue of $504.9 million, which fell short of the analyst estimate of $520.89 million. However, the company's non-GAAP diluted earnings per share (EPS) of $1.64 exceeded the estimated EPS of $0.74. The GAAP diluted EPS was $0.59, which is below the estimated EPS of $0.74. This performance highlights the company's ability to manage costs effectively, even as revenue growth faced challenges.

Financial Achievements and Industry Context

The company achieved a GAAP operating profit margin of 11.7% and a non-GAAP operating profit margin of 33.5%. Operating cash flows were robust at $398.9 million, with unlevered operating cash flows reaching $407.1 million. These metrics are crucial for software companies like Ansys, as they indicate strong operational efficiency and cash generation capabilities, which are vital for sustaining innovation and growth in a competitive industry.

Key Financial Metrics

Below is a summary of key financial metrics from Ansys Inc's Q1 2025 results:

| Metric | Q1 2025 | Q1 2024 | % Change |

|---|---|---|---|

| Revenue | $504.9 million | $466.6 million | 8.2% |

| Net Income | $51.9 million | $34.8 million | 49.1% |

| GAAP EPS | $0.59 | $0.40 | 47.5% |

| Gross Margin | 85.6% | 85.3% | - |

| Operating Profit Margin | 11.7% | 9.3% | - |

Strategic Developments and Challenges

Ansys Inc's strategic direction includes a pending acquisition by Synopsys, Inc., which has received clearance from several regulatory bodies, including the U.K. Competition and Markets Authority. This acquisition is expected to close in the first half of 2025, subject to remaining approvals. The transaction could significantly impact Ansys's market position and operational dynamics.

The results for the first quarter met the Company’s expectations and it continues to expect double-digit FY 2025 ACV growth," the company stated in its filing.

Analysis and Conclusion

Ansys Inc's Q1 2025 results demonstrate strong earnings performance despite revenue challenges. The company's ability to exceed non-GAAP EPS expectations reflects effective cost management and operational efficiency. However, the revenue shortfall against estimates indicates potential market challenges or competitive pressures. The pending acquisition by Synopsys presents both opportunities and uncertainties, which investors should monitor closely as the transaction progresses.

Explore the complete 8-K earnings release (here) from Ansys Inc for further details.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10