Financial services company, Robinhood Markets Inc. (NASDAQ:HOOD), is working towards allowing its 25 million predominantly small, retail customers access to private company shares.

What Happened: During its first quarter earnings call on Wednesday, Robinhood CEO Vlad Tenev told investors that expanding retail access to private markets was one of its “top policy priorities.”

“We believe it's actually quite crazy that customers can't invest in private companies, given that private companies are staying private longer,” Tenev said. He pointed to companies like OpenAI and SpaceX, which are valued at hundreds of billions, while still remaining private, noting, “Those gains are accruing to a smaller and smaller group of insiders.”

See More: ‘Sell In May’ Might Have Rung True Once Upon A Time On Wall Street, But The Popular Adage Rings Hollow Today

Tenev said Robinhood already has the technology in place to enable this access, referring to the tokenization of private company shares. “What's needed is comprehensive securities legislation,” he said, adding that current accredited investor rules also need to be reconsidered, as they “shut out north of 80% of the public currently.”

The company is currently involved in active discussions on this issue, and there is a willingness among lawmakers and the administration regarding this, according to Tenev, who is confident about making progress.

Why It Matters: Recently, Tenev penned an op-ed for The Washington Post pushing for tokenization, arguing that this would unlock value for companies, investors, and crypto technology.

Robinhood has been steadily working to bridge the gap between retail and institutional investors, with its latest step in that direction being the launch of its Cortex AI tool.

It has since also come out with its roboadvisor service, Robinhood Strategies, particularly aimed at younger investors, and offering active portfolio monitoring services with annual fees of 0.25% of assets managed, capped at $250 per year.

Price Action: The stock was down 0.53% on Wednesday, but is up 1.45% pre-market, following the company’s beat on consensus estimates during its first quarter earnings.

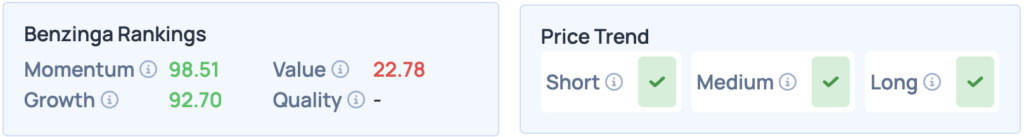

According to Benzinga Edge Stock Rankings, Robinhood scores well on momentum and growth, with a favorable price trend in the short, medium, and long term. For more such insights, sign up for Benzinga Edge.

- Read More: Short Seller Jim Chanos Slams Trump’s Reindustrialization Hopes: Says $3-Per-Hour Apple Supplier Foxconn Workers Were ‘Too Expensive’ — Questions If ‘Those Jobs Are Coming Back’

Image Via Shutterstock