Canary Capital Files for First-Ever Staked SEI ETF With SEC

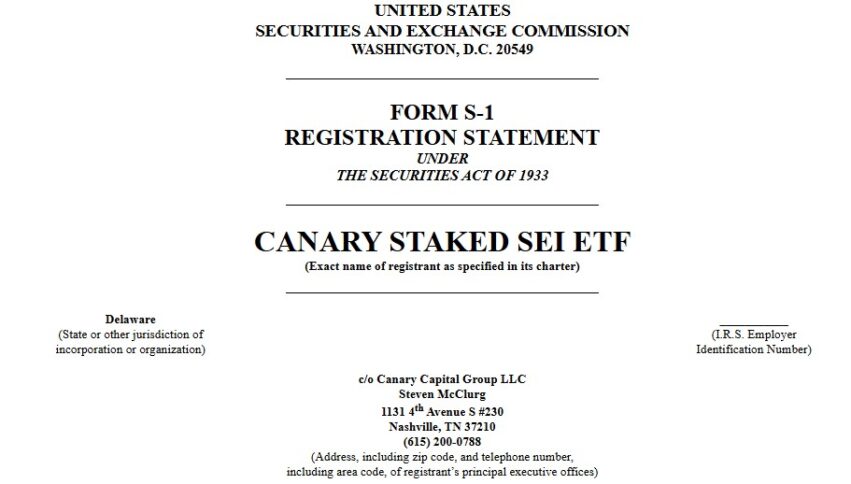

Canary Capital has submitted to the SEC to list its first-ever Staked SEI ETF, a novel financial product that would allow investors to directly invest in SEI, the native token of the Sei Network.

It will seek to replicate the spot market price of SEI as determined by CoinDesk Indices, and its NAV will be priced at 4 PM New York time each day. This product will not use derivatives and will hold actual SEI tokens in its custody.

The two custodians for the ETF will be BitGo Trust Company and Coinbase Custody Trust Company to hold SEI tokens safely. These are not insured by the FDIC but they have insurance policies to minimize risks of losses.

The ETF is an efficient means of investing in SEI through a regular brokerage account without the need to understand how the blockchain works or the concept of private keys.

One of the unique aspects of the Canary Staked SEI ETF is the staking process. The fund will also earn more SEI tokens through staking, which is a process of verifying transactions on the Sei Network through the proof-of-stake (PoS) consensus mechanism.

This staking reward system gives the investors the opportunity to earn additional income in addition to the possibility of benefiting from the fluctuations of the SEI price.

This ETF is part of Canary Capital’s plan to list more ETFs that track digital currencies, after submitting a similar application for TRX. The approval of the SEI ETF by the SEC is still pending, but this makes it easier for traditional investors to invest in digital assets by holding tokens and receiving staking rewards.

Also Read: Canary Capital Files for First-Ever TRX Spot ETF With SEC

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10