Robinhood Markets Inc. (NASDAQ:HOOD) reported a marked decline in its cryptocurrency revenue in the first quarter as compressed prices hampered trading activity.

What happened: The commission-free trading platform released its quarterly financials after Wednesday’s market close and disclosed a cryptocurrency notional trading volume of $252 million, up 100% year-over-year but down 30% from the previous record quarter.

The cryptocurrency revenue was over 43% of Robinhood's total transaction-based revenue for the quarter.

The firm also revealed a cryptocurrency notional trading of $46 billion, up 28% from the same quarter last year but down 35% from the fourth quarter of 2024.

See Also: PayPal CEO Says ‘Moving Quickly’ To Bring Crypto, Stablecoin Benefits To Users — Fintech Giant Partners With Coinbase To Boost Solana-based PYUSD

The company’s cryptocurrency arm, Robinhood Crypto, allows users to trade in popular coins such as Bitcoin (CRYPTO: BTC), Ethereum (CRYPTO: ETH), Dogecoin (CRYPTO: DOGE), and others.

Why It Matters: The fall in volume and revenue followed a marked contraction in the cryptocurrency market in the first quarter, with total capitalization falling by more than 18%. Notably, Bitcoin and Ethereum plunged 11.82% and 45.41%, respectively, during the period.

During the earnings call, Robinhood CEO Vlad Tenev said it was normal for trading volumes to fluctuate, but he was pleased that the company’s market share was intact.

Tenev also talked about diversifying the business away from cryptocurrency. "We're diversifying the business outside of the crypto business, which will make us less reliant on crypto transaction volumes," the CEO said.

Price Action: Shares of Robinhood rose 1.45% in after-hours trading after closing 0.53% lower at $49.11 during Wednesday’s trading session, according to data from Benzinga Pro. Year-to-date, the stock has gained 31.80%.

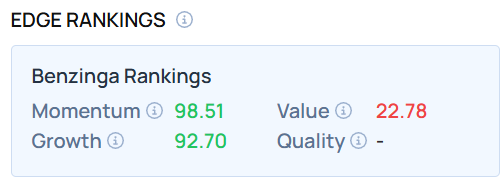

The stock exhibited a very high momentum score as of this writing. Benzinga Edge Stock Rankings can help you see how other crypto-focused companies stack up on this metric.

Photo Courtesy: Sergei Elagin On Shutterstock.com

Read Next:

- Nuclear-Armed India, Pakistan Heading For Conflict Again? Polymarket Bettors Think Yes Amid Pak Minister’s ‘Imminent’ Attack Remark