McDonald's Corp. (NYSE:MCD) is kicking off 2025 with a warning about a growing divide among U.S. consumers, noting a clear split along income lines.

What Happened: During its first quarter earnings call on Thursday, McDonald’s CEO, Chris Kempczinski’s opening remarks centered around the declining foot traffic in the quick-service restaurant industry, especially from the low and middle income consumer cohort, both of which are down nearly 10% compared to the prior year quarter.

However, traffic among high-income consumers remains strong, which Kempczinski said “illustrates the divided U.S. economy, where low- and middle-income consumers in particular are being weighed down,” by factors such as inflation and a bleak economic outlook.

During the Q&A session, CFO Ian Borden noted that McDonald's customer base skews toward low- and middle-income consumers, prompting the company to double down on its commitment to “strong value” and “affordability” across its menu offerings.

Borden adds that this value-focused strategy helped McDonald's outperform its closest competitors on same-store guest counts during the first quarter.

See More: Reddit Stock Spikes Over 6% After-hours After Earning Beat, Platform Considers Putting Ads In Comments To Monetize High ‘Engagement’

Why It Matters: The company experienced a 3.6% year-over-year decline in same-store sales during the quarter, which marks its steepest decline since 2020, during the COVID-19 pandemic. As a result, McDonald’s missed consensus estimates, with $2.67 in earnings per share, from $5.96 billion in revenue.

This coincides with the Consumer Sentiment Index crashing to a three-year low in April, at 50.4, down from 57 in March, with tariffs, inflation expectations, and market reactions taking their toll.

Amazon.com Inc. (NASDAQ:AMZN) CEO Andy Jassy expressed similar concerns during the company's first-quarter earnings call on Thursday, pointing to shifts in consumer behavior reminiscent of the pandemic. “There's maybe never been a more important time in recent memory than now to try to keep prices low,” he said.

Price Action: The stock was down 1.88% on Thursday, and is currently down 0.20% after hours following the company’s earnings release.

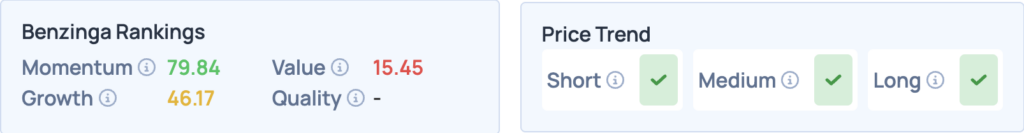

McDonald’s has a favorable price trend in the short, medium, and long term, but how does it compare with peers and competitors? Sign up for Benzinga Edge for more insights.

Photo Courtesy: New Africa On Shutterstock.com

Read More:

- Elon Musk’s Exit As CEO Means 25% Drop In Tesla Stock Price: Gary Black Highlights Why Musk’s Leadership Still Anchors Tesla’s Valuation