Broadridge Financial Solutions Q3 Earnings: EPS of $2.05 Misses Estimate, Revenue at $1,812 Million Below Expectations

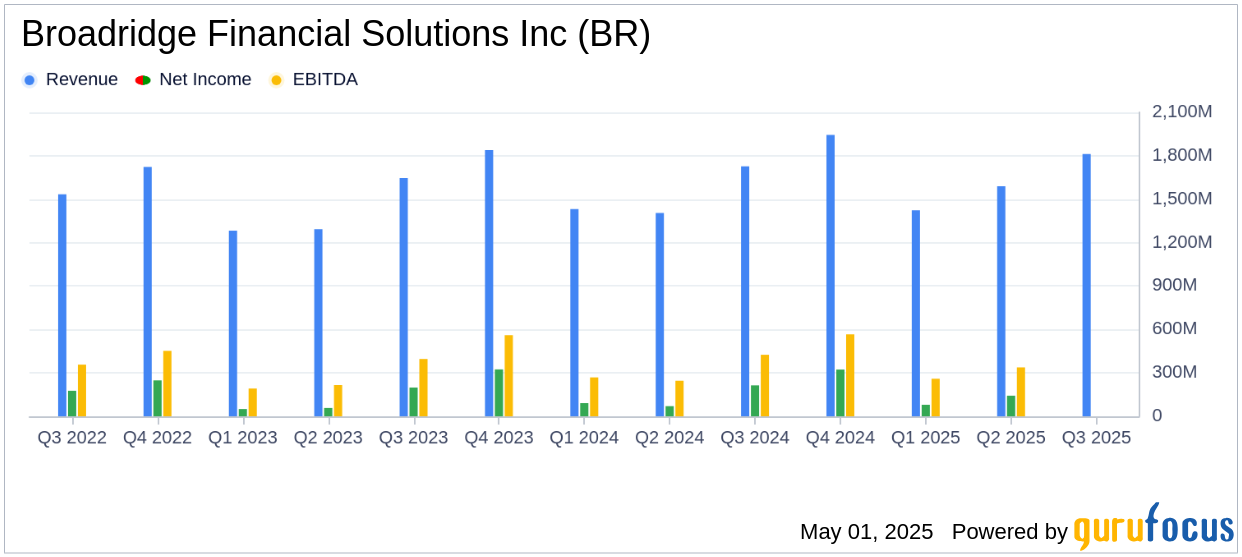

On May 1, 2025, Broadridge Financial Solutions Inc (BR, Financial) released its 8-K filing for the third quarter of fiscal year 2025, showcasing a mixed performance with notable revenue growth but a slight miss on earnings per share (EPS) compared to analyst estimates. The company, a leader in investor communication and technology-driven solutions, reported a diluted EPS of $2.05, falling short of the estimated $2.07. However, the adjusted EPS of $2.44 surpassed expectations, reflecting a 9% increase from the previous year.

Company Overview

Broadridge Financial Solutions, spun off from Automatic Data Processing in 2007, is a prominent provider of investor communication and technology solutions for banks, broker/dealers, asset managers, wealth managers, and corporate issuers. The company operates through two main segments: Investor Communication Solutions (ICS) and Global Technology and Operations (GTO).

Performance Highlights and Challenges

Broadridge reported a 5% increase in total revenues to $1,812 million, driven by a 7% rise in recurring revenues to $1,204 million. The constant currency growth for recurring revenues was 8%, indicating strong organic growth in both ICS and GTO segments. However, event-driven revenues saw a decline of 21% due to reduced equity proxy contest activity, posing a challenge for the company.

Financial Achievements and Industry Significance

The company's operating income rose by 14% to $345 million, with an operating margin improvement to 19.0% from 17.5% in the prior year. This growth underscores Broadridge's resilience and strategic positioning in the software industry, where consistent revenue streams and operational efficiency are crucial for long-term success.

Key Financial Metrics

Broadridge's net earnings increased by 14% to $243 million, while adjusted net earnings rose by 8% to $289 million. The effective tax rate increased to 21.8% from 19.8% in the previous year, primarily due to lower discrete tax benefits. The company's balance sheet remains robust, with total assets of $8,299.6 million and stockholders' equity of $2,382.3 million.

| Metric | Q3 2025 | Q3 2024 | Change |

|---|---|---|---|

| Total Revenues | $1,812 million | $1,726 million | 5% |

| Operating Income | $345 million | $303 million | 14% |

| Diluted EPS | $2.05 | $1.79 | 15% |

| Adjusted EPS | $2.44 | $2.23 | 9% |

Segment Performance

The ICS segment reported a 4% increase in total revenues to $1,348 million, with recurring revenues up by 6% to $740 million. The GTO segment saw a 9% rise in recurring revenues to $464 million, bolstered by the acquisition of Kyndryl’s Securities Industry Services business and organic growth.

Analysis and Outlook

Broadridge's performance in Q3 fiscal 2025 highlights its ability to navigate market uncertainties while maintaining steady growth. The company's reaffirmation of its fiscal year 2025 guidance, with recurring revenue growth of 6-8% and adjusted EPS growth in the middle of the 8-12% range, reflects confidence in its strategic initiatives. However, the decline in event-driven revenues and the slight miss on EPS estimates indicate areas for potential improvement.

“Broadridge delivered strong third quarter results, including 8% Recurring revenue growth constant currency and 9% Adjusted EPS growth,” said Tim Gokey, Broadridge CEO. “Our continued execution is being driven by the resilience of our business and powerful long-term trends.”

For more detailed insights and analysis, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Broadridge Financial Solutions Inc for further details.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10