Chainlink price slowly forms a bullish pattern as whale holdings rise 6 seconds ago

Chainlink price moved sideways on Friday, but the ongoing whale activity and technicals point to an eventual rebound.

Chainlink (LINK) was trading at $14.20, where it has stalled over the past few days. This price is about 45% above its lowest level this year.

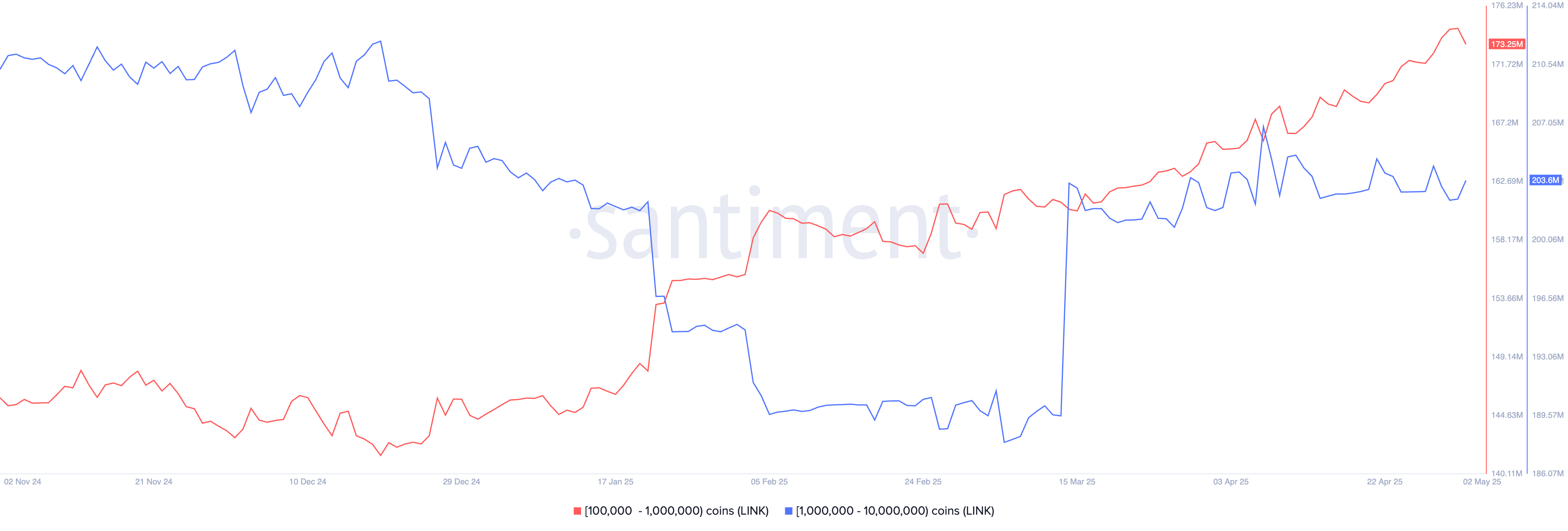

Whale activity suggests that the coin may stage a strong comeback in the coming days. Santiment data shows that large investors have been accumulating LINK over the past few months.

Investors holding between 100,000 and 1 million coins now own 173 million LINK, up from a low of 143 million in November last year. Their holdings have increased by 30 million coins, currently valued at approximately $420 million.

Whales with between 1 million and 10 million coins have increased their holdings to 203 million from 183 million in February.

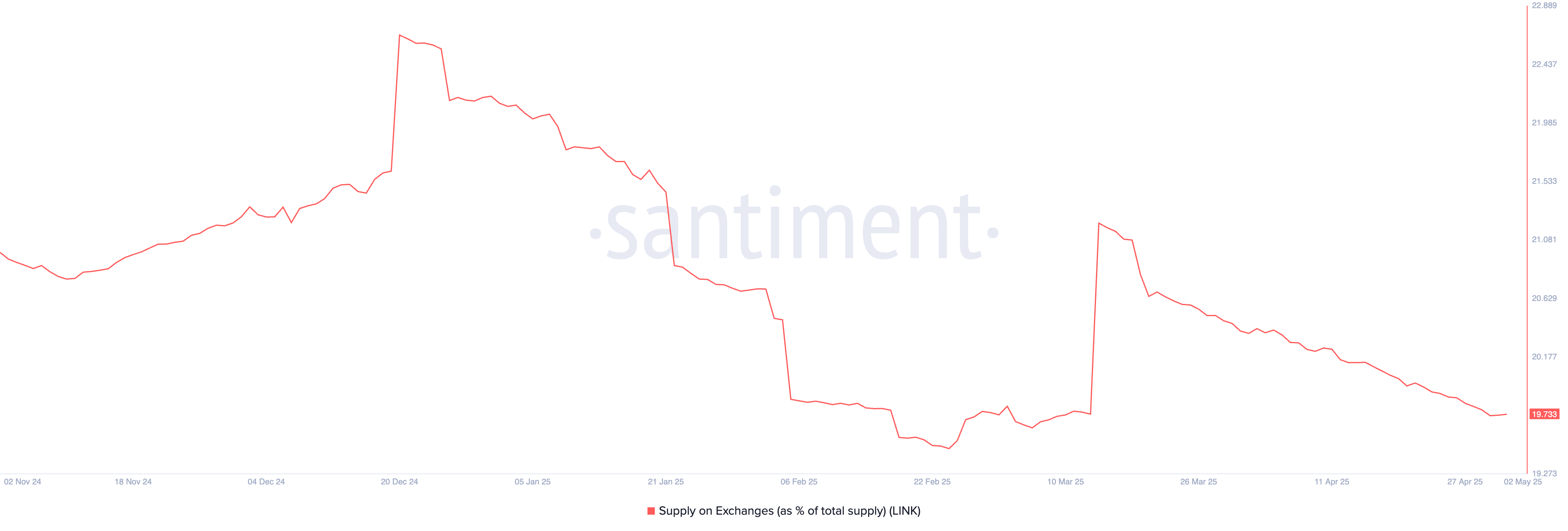

Additional data shows that the supply of LINK tokens on exchanges, as a percentage of total supply, has continued to decline. It has dropped from 21% in March to 19%, its lowest level since March 13.

A drop in exchange balances is typically a bullish signal, suggesting that holders are moving tokens off exchanges and are less likely to sell. In most cases, supply increases on exchanges when holders prepare to liquidate positions.

A likely catalyst for Chainlink is its partnership with major institutions like Swift and the Depository Trust & Clearing Corporation. DTCC is exploring the use of Chainlink’s Cross-Chain Interoperability Protocol to modernize mutual fund data dissemination. This is significant, as DTCC processes more than $3.7 quadrillion annually.

Swift also wants to use Chainlink’s solutions to move tokenized assets by large financial services companies globally. Like DTCC, Swift Network handles over $150 trillion annually.

Chainlink price technical analysis

The 12-hour chart shows that LINK has rebounded in recent weeks, rising from a low of $9.9720 in April to around $14. It is now trading above the 50-period moving average.

The coin formed a falling wedge pattern, a popular bullish reversal sign. It has also formed an inverse head and shoulders pattern. LINK will likely continue rising as bulls target the next point at $20, up by 30% above the current level.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10