Fortive Corp Q1 2025 Earnings: Adjusted EPS of $0.85 Surpasses Estimates, Revenue at $1.47 Billion Misses Expectations

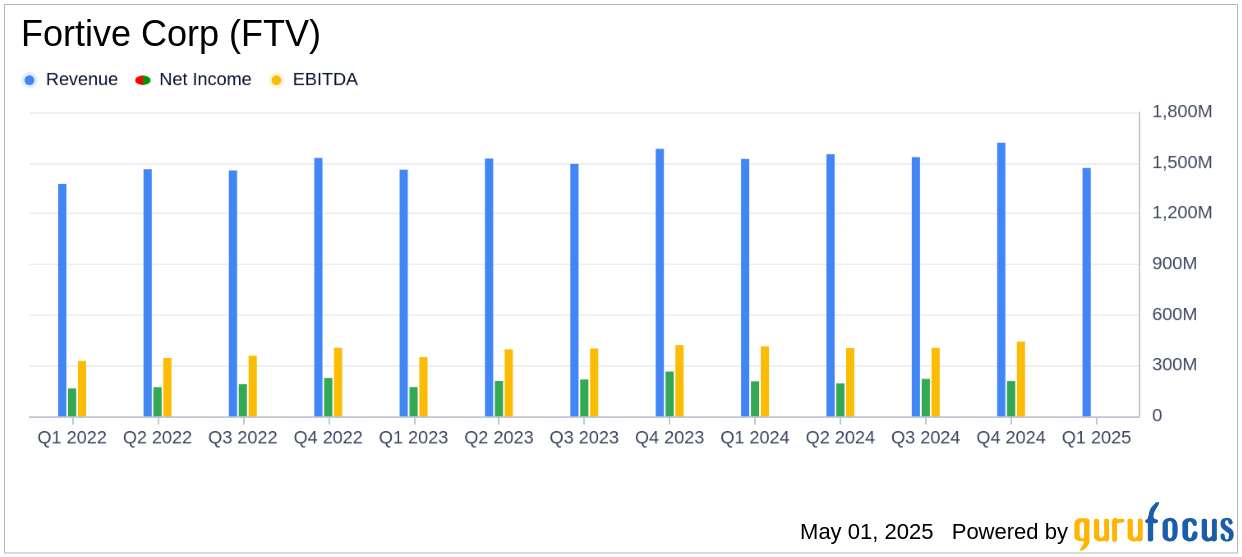

Fortive Corp (FTV, Financial) released its 8-K filing on May 1, 2025, detailing its financial performance for the first quarter of 2025. The diversified industrial technology firm, known for its mission-critical products and services across various sectors, reported a GAAP diluted net EPS of $0.50 and an adjusted diluted net EPS of $0.85, surpassing expectations. However, the company faced a 3% year-over-year revenue decline, totaling $1.47 billion, which included a 2% core revenue decline.

Company Overview

Fortive Corp (FTV, Financial) is a leading provider of essential technologies for connected workflow solutions, serving diverse markets such as manufacturing, utilities, medical, and electronics. With a broad portfolio that includes Intelligent Operating Solutions, Precision Technologies, and Advanced Healthcare Solutions, Fortive generated approximately $6.2 billion in revenue in 2024.

Performance and Challenges

Fortive Corp (FTV, Financial) demonstrated resilience in its Intelligent Operating Solutions and Advanced Healthcare Solutions segments, driven by strong demand for safety and productivity solutions. However, the Precision Technologies segment experienced delays in customer investments due to geopolitical and macroeconomic uncertainties. This segment's challenges highlight potential risks in maintaining growth momentum amid external pressures.

Financial Achievements

The company reported an operating profit margin of 15.8%, with an adjusted operating profit margin of 25.3%, marking a 20 basis point increase year-over-year. This improvement was attributed to robust performance in Intelligent Operating Solutions. Additionally, Fortive generated cash flow above expectations, with a 5% year-over-year increase in trailing twelve-month reported operating cash flow, underscoring its strong cash generation capabilities.

Key Financial Metrics

Fortive's income statement revealed net earnings of $172 million for the first quarter, with adjusted net earnings reaching $292 million. The balance sheet showed total assets of $17.137 billion, with cash and equivalents rising to $892.1 million from $813.3 million at the end of 2024. The company's cash flow statement highlighted net cash provided by operating activities of $241.7 million, reflecting efficient cash management.

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Revenue | $1.47 billion | $1.52 billion |

| Net Earnings | $172 million | $207.4 million |

| Adjusted Net Earnings | $292 million | $295.3 million |

| Operating Profit Margin | 15.8% | 19.8% |

Analysis and Outlook

Fortive Corp (FTV, Financial) has shown adaptability in navigating a challenging macroeconomic environment, as evidenced by its strong EPS performance and cash flow generation. However, the revenue decline and challenges in the Precision Technologies segment underscore the need for strategic adjustments. The company's focus on separating its Precision Technologies business into an independent entity, Ralliant, by the end of Q2 2025, is a strategic move aimed at enhancing focus and operational efficiency.

James A. Lico, President and CEO, commented, "Our first quarter results reflect our continued ability to adapt and respond to the current dynamic macroeconomic environment. Despite the increased uncertainty impacting some of our customers, our culture of continuous improvement and our world-class Fortive Business System (FBS) are allowing us to navigate these challenges, seize opportunities, and continue to drive differentiated performance."

Fortive's updated guidance for 2025 anticipates diluted net earnings per share of $2.23 to $2.43 and adjusted diluted net earnings per share of $3.80 to $4.00, reflecting moderated demand in Precision Technologies and the impact of global tariffs. The company's strategic initiatives and operational execution will be crucial in achieving these targets and sustaining long-term growth.

Explore the complete 8-K earnings release (here) from Fortive Corp for further details.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10