DashPass, DoubleDash And Drones: DoorDash Plans To 'Connect Every Local Business To Every Local Consumer'

DoorDash Inc. (NASDAQ:DASH) is shifting its focus beyond food delivery, with CEO Tony Xu outlining plans during the company's earnings call to expand more broadly into local commerce through a range of new services and tech innovations.

What Happened: On Tuesday, during the company’s first quarter earnings call, Xu spoke of the company’s goal of “connecting every local business to every local consumer,” before outlining how recent product moves, such as the DashPass membership program, the DoubleDash service, and its investments in autonomous deliveries fit into the same.

Xu sees a lot more potential in DashPass, beyond just the free deliveries that DoorDash users have come to expect. He calls it a “membership to the physical world,” designed to engage and offer a growing array of local services. “There would be no other program in which you would have more or gain more utility,” he says.

See More: Nvidia CEO Jensen Huang Says Losing Access To China’s Potential $50 Billion AI Market Would Be A ‘Tremendous Loss’

DoubleDash, which allows users to shop from multiple stores in a single order with no added fees, will soon feature every retail catalog in their respective cities, according to Xu. He, however, adds that “we're still in the work of just getting the basics right.”

Xu says DoorDash will be rolling out its autonomous delivery tech in Los Angeles, which it continues to test in other markets. “You don't need a 4,000-pound vehicle to deliver a one- or two-pound item or package,” he says, while adding that the first and last “10 feet problem” still needs to be solved.

Why It Matters: The company recently entered into hemp-derived THC and CBD deliveries, a niche which the company notes has high repeat purchases and basket sizes, since orders are often bundled with alcohol and snacks.

Early this week, the company announced its intent to acquire European food delivery company, Deliveroo PLC (OTCMKTS: DROOF) in a $3.9 billion deal, which would allow the combined companies to serve 1 billion people across 40 different countries.

DoorDash is already a dominant player in urban markets. Domino’s Pizza Inc. (NASDAQ:DPZ), which was holding out against delivery services for years, finally made the decision to join the platform, after realizing the incremental sales it can provide in the face of dropping same-store sales, calling third-party platforms a $1 billion opportunity for the company.

However, DoorDash's use of its dominant position to gain a competitive edge has come under scrutiny. Uber Technologies Inc. (NYSE:UBER), which operates rival platform Uber Eats, has filed a lawsuit accusing DoorDash of engaging in anticompetitive conduct for pressuring restaurants into exclusivity contracts.

During its first quarter results on Tuesday, DoorDash reported $3.03 billion in revenue, up 21% YoY, but missed top-line estimates at $3.09 billion. It posted a profit of $0.44 per share, ahead of consensus estimates at $0.39 per share.

Price Action: The stock was down 7.44% on Tuesday, following the company’s miss on revenue estimates, it is now up 0.75% after hours.

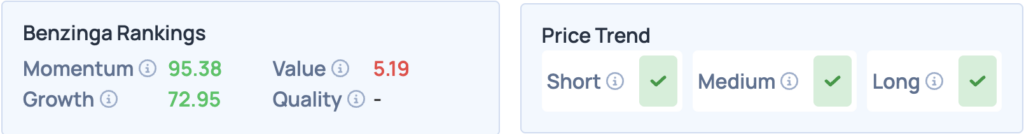

According to Benzinga’s Edge Stock Rankings, DoorDash scores well on Momentum and Growth, while showing a favorable price trend in the short, medium, and long terms. For more insights, sign up for Benzinga Edge.

Photo Courtesy: rblfmr on Shutterstock.com

Read More:

- OpenAI To Slash Microsoft Revenue Share By 2030: Report

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10