Why is the crypto market down today? 8 seconds ago

Crypto markets are down 0.48%, reflecting the drop in stock markets and technical pressures on Bitcoin.

Crypto markets faced minor selling pressure from both macroeconomic factors and Bitcoin technicals. On Tuesday, May 6, the overall crypto market cap declined 0.54%, falling below $3 trillion to $2.94 trillion.

The main driver of the decline mirrored the same factors weighing on equities. The Dow Jones lost more than 400 points, or 1.00%, while other major indices also fared poorly. Typically, Bitcoin (BTC) and the broader crypto market, are correlated with stocks, which likely means that similar factors influence both.

In this case, macroeconomic uncertainty and renewed fears over Donald Trump’s tariffs contributed to the bearish sentiment. Notably, just a day prior, Trump announced new tariffs on pharmaceuticals, after already targeting movies. These new tariff announcements are causing concern among traders, as they suggest Trump is not backing away from his aggressive trade stance.

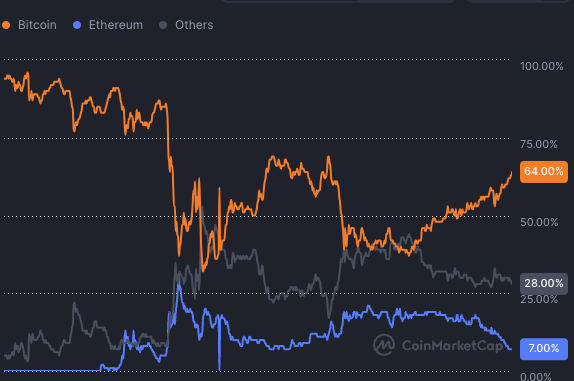

Despite the overall decline, Bitcoin was more resilient than most altcoins, managing to increase its dominance to 64.1%, the highest level since January 2021. Still, while Bitcoin recovered some of its earlier losses today from a low of $93,400, its price is still just slightly below what it was 24 hours ago, registering a 0.01% loss at $94,841.

Bitcoin faces technical pressures

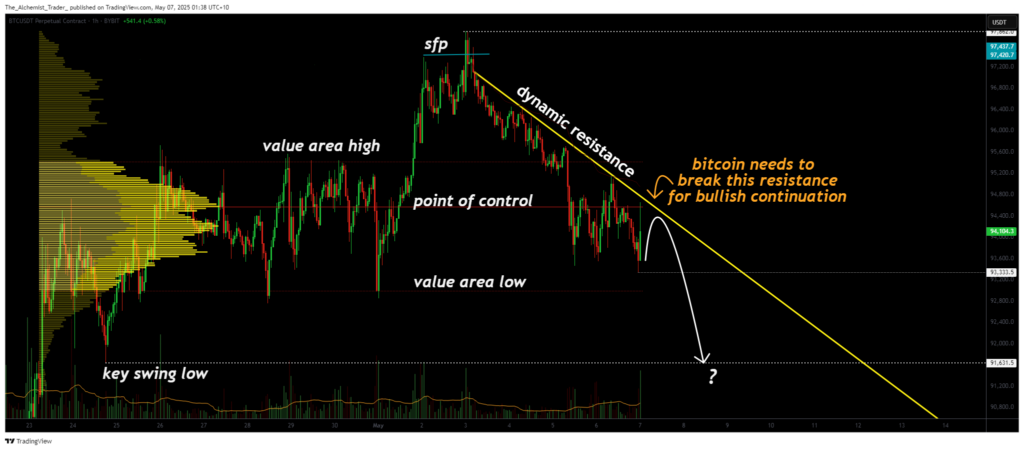

One of the reasons for Bitcoin’s underwhelming performance comes down to technical factors, which is unlikely to change very soon. Specifically, Bitcoin is facing a long-term dynamic resistance that started forming after its all-time high in January.

Since then, Bitcoin has consistently stayed below the resistance point, with a last breakout attempt on April 23. This means that further declines are likely, especially as its price has passed the point of control. That is, unless a major catalyst enables it to break this long-term resistance.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10