Binance’s latest proof of reserves report reveals over 100% backed assets for major tokens 8 seconds ago

Binance published its updated monthly proof of reserves report for May 2025, showing the exchange’s backed assets remain over 100% for major tokens such as Bitcoin, USDT and Ethereum.

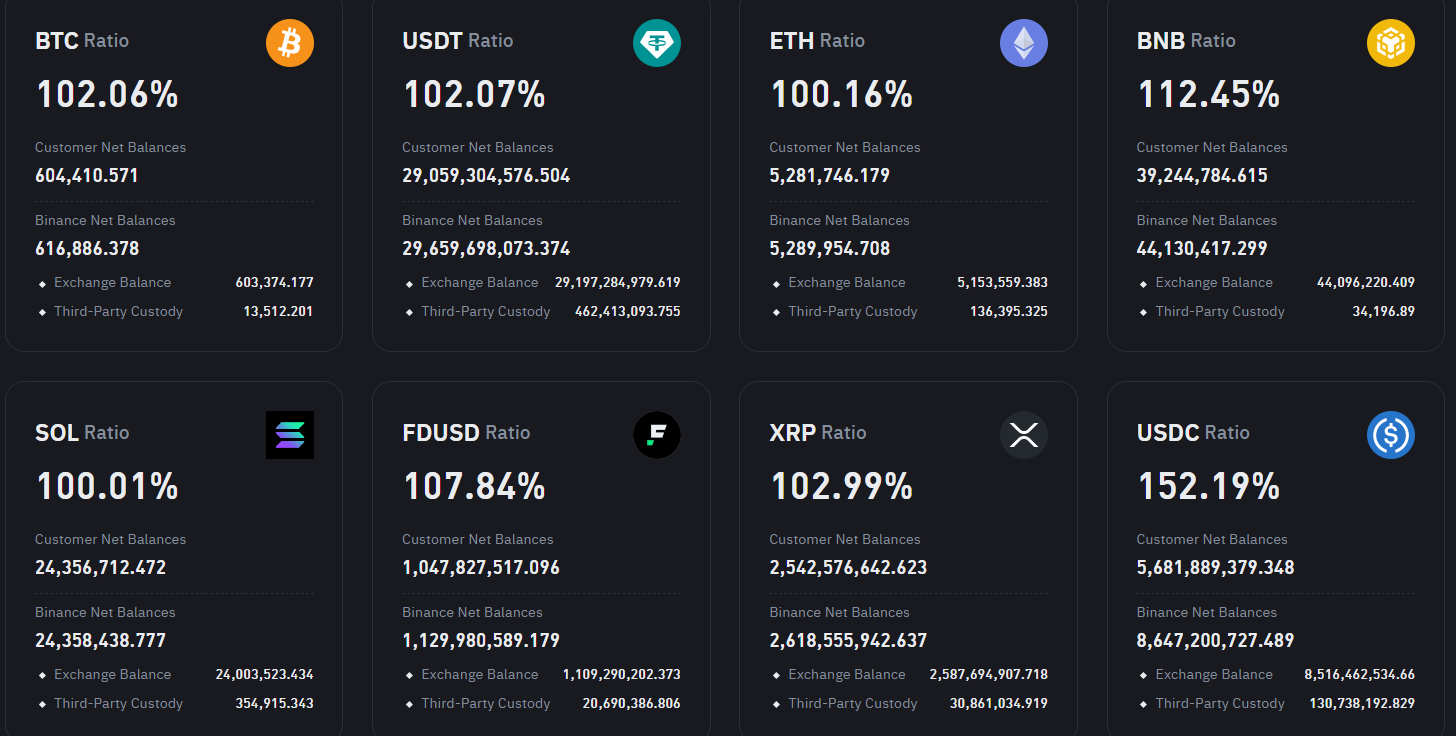

On May 8, the leading crypto exchange released the latest update for its crypto reserves, featuring the stats of the crypto exchange’s backed reserves for 37 crypto assets. The report revealed that the exchange controls 616,886.378 BTC (BTC), which stands at a 102.06% ratio compared to customer’s net assets which are currently at 604,886.378 BTC.

The same can be said about the exchange’s backed USDT (USDT) reserves. At the moment, Binance holds more than 29.6 billion USDT, exceeding its customer-held assets by a 102.07% ratio or around 600 million USDT.

Meanwhile, the exchange’s Ethereum (ETH), Solana (SOL) and Ripple (XRP) reserves also remain well above the 1:1 ratio. The platform currently controls 5,289,954 ETH, exceeding its customer net balances by more than 8,000 ETH. Its Solana-backed reserves also graze over the 100% mark by 0.01% or equal to a 2,000 SOL surplus.

Binance’s Ripple reserves remain at a 102.99% ratio or around 2.6 billion XRP. The exchange’s reserves surpass customer-held assets by nearly 76 million XRP.

The platform’s largest backed asset remain Binance USD (BUSD), maintaining a reserve amounting to more than double its customer balances or approximately 206.04%. The crypto exchange has long-ceased support for it USD-pegged stablecoin since it closed its U.S. markets in 2023.

However, in February this year the exchange’s U.S. branch reopened USD transactions for the first time since it closed down the service in June 2023 due to the SEC lawsuit.

Moreover, the exchange holds more than 8.6 billion USDC (USDC) in its reserves or equal to 152.19% of it customer-held assets. The platform’s customer net balances hold 5.6 billion USDC at the moment. Meanwhile, its FDUSD (FDUSD) reserves stand at a ratio of 107.84%, exceeding customer asset holdings by more than 82 million FDUSD.

Proof of reserves is information relayed by centralized crypto exchange’s to assure customers that their deposits are fully backed by on-chain reserves. The crypto exchange introduced this concept after the bankruptcy of FTX to demonstrate its readiness to cover any volume of withdrawal requests.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10