Ethereum’s stablecoin market cap jumps 1m-fold since the first time ETH reached $1,4k 5 seconds ago

The total stablecoin market cap in the Ethereum ecosystem has jumped approximately 1 million-fold since the token reached $1,400 for the first time in January 2018.

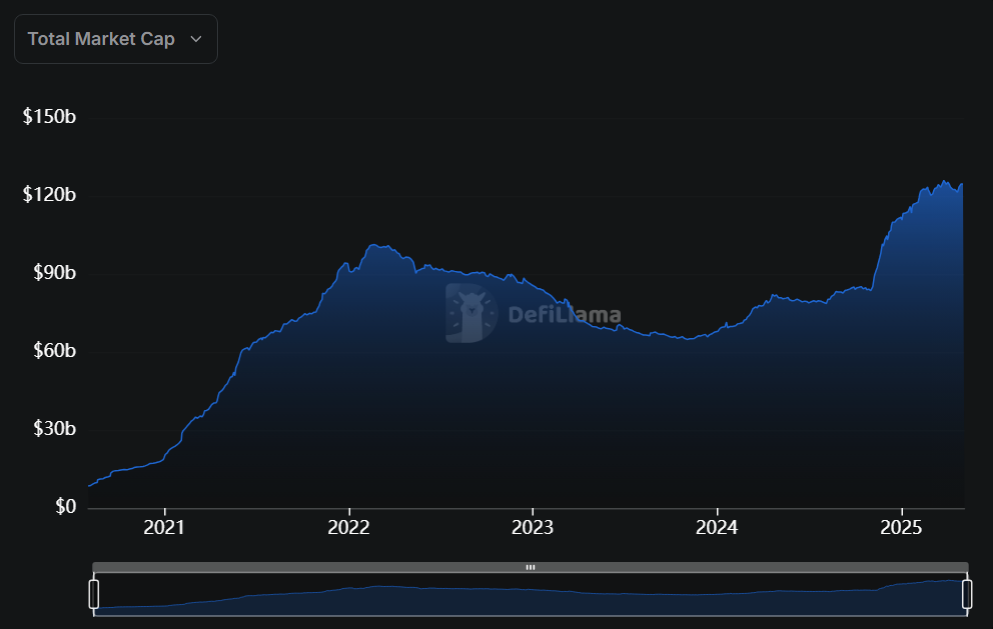

According to data on DeFi Llama, the ETH (ETH) stablecoin market cap has gone up to around $124.5 billion on May 6. However, it has declined by 0.08% or around $100 million in the past week.

In January 2018, when ETH hit $1,400 for the first time in history, its stablecoin market cap sat at a measly $124,500. Despite its meager beginnings compared to its current state, it was enough to cement Ethereum’s place as the second-largest cryptocurrency by market cap, falling behind only to Bitcoin (BTC).

At press time, Tether (USDT) continues to contribute the majority of ETH’s stablecoin market cap, making up around 52% of the ecosystem’s total stablecoin market cap or equal to around $64.7 billion from the $124.5 billion total.

On the other hand, USD Coin (USDC) injects $37 billion in market cap to the ETH ecosystem, followed by Ethena’s USDe (USDE) which makes up $4.5 billion of the total stablecoin market cap. Fourth and fifth place are occupied by Sky Dollar’s USDS and Dai’s DAI (DAI), contributing around $3.8 billion and $3.6 billion in stablecoin market cap respectively.

At press time, ETH itself has dipped slightly by 0.89% in the past 24 hours. It is currently trading hands at $1,804, having jumped more than 10.9% in the past two weeks. ETH’s market cap stands at more than $216 billion, with a daily trading volume reaching $9.2 billion. This marks a slight 4.10% increase in trading volume compared to the previous day of trading, indicating a rise in market activity.

As preciously reported by crypto.news, Ethereum is preparing to launch is next major upgrade this month. The upgrade is set to introduce a number of changes aimed at boosting on-chain scalability, improving user experience, and enhancing validator efficiency through EIP-7251’s maximum stake adjustment from from 32 ETH to 2,048 ETH.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10