Tyson Foods Q2 2025 Earnings: Revenue at $13.07 Billion, GAAP EPS Falls to $0.02, Adjusted EPS at $0.92

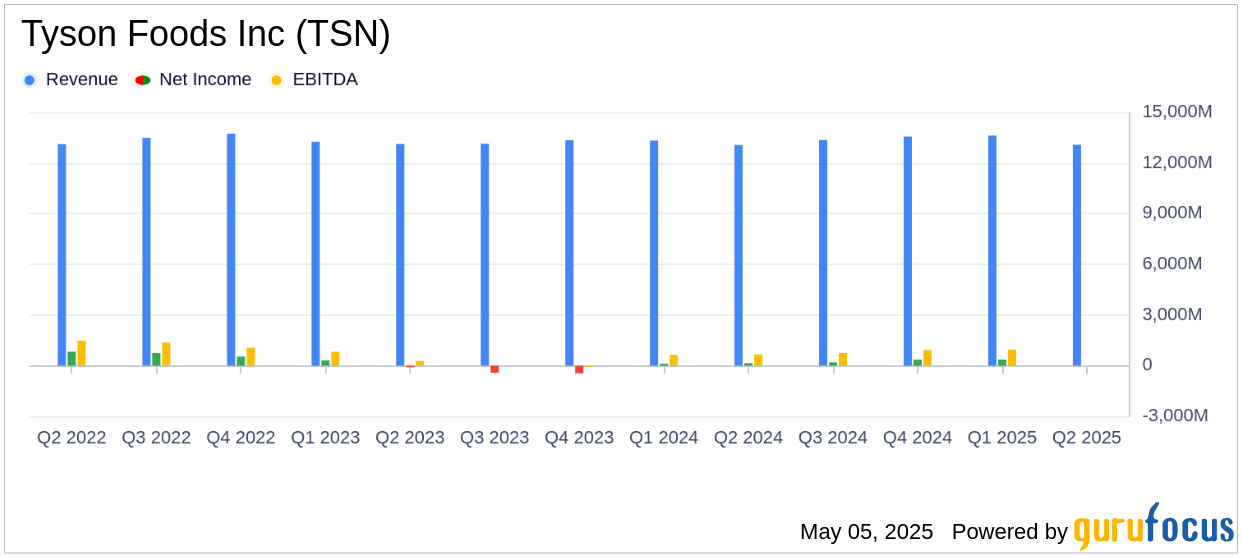

On May 5, 2025, Tyson Foods Inc (TSN, Financial) released its 8-K filing for the second quarter of 2025, revealing a mixed financial performance. The company, a leading protein-focused food producer, reported quarterly sales of $13,074 million, closely aligning with the analyst estimate of $13,137.39 million. However, the reported earnings per share (EPS) of $0.02 fell significantly short of the estimated $0.74, indicating challenges in profitability.

Company Overview

Tyson Foods Inc (TSN, Financial) is a major player in the protein food industry, specializing in chicken, beef, pork, and prepared foods. The company’s largest segments, chicken and beef, each contribute about one-third of U.S. sales, while prepared foods account for 18% of fiscal 2024 sales. Despite its strong brand portfolio, Tyson faces stiff competition in these categories. International sales represent a modest 4% of total revenue, with recent acquisitions focusing on expanding international and food-service markets.

Performance and Challenges

Tyson Foods Inc (TSN, Financial) reported flat sales year-over-year at $13,074 million for the second quarter, with legal contingency accruals reducing sales by $343 million, or 2.6%. The company's GAAP operating income dropped by 68% to $100 million, reflecting a challenging operating environment. The adjusted operating income, however, increased by 27% to $515 million, showcasing some resilience in operational efficiency.

The significant decline in GAAP EPS to $0.02, a 95% decrease from the previous year, underscores the profitability challenges Tyson faces. In contrast, the adjusted EPS rose by 48% to $0.92, highlighting the impact of non-recurring items on the company's financials.

Financial Achievements and Industry Importance

Despite the challenges, Tyson Foods Inc (TSN, Financial) achieved a 44% increase in adjusted operating income for the first six months of 2025, reaching $1,174 million. This improvement is crucial for maintaining competitiveness in the consumer packaged goods industry, where operational efficiency and cost management are key to sustaining margins.

Key Financial Metrics

From the income statement, Tyson's gross profit margin decreased to 4.6% from 6.6% in the previous year, reflecting increased cost pressures. The operating margin also declined to 0.8% from 2.4%. On the balance sheet, total assets stood at $36,280 million, with a notable reduction in long-term debt by $738 million during the quarter, enhancing financial stability.

Segment Performance

| Segment | Sales (Q2 2025) | Operating Income (Q2 2025) | Adjusted Operating Income (Q2 2025) |

|---|---|---|---|

| Beef | $5,196 million | $(258) million | $(149) million |

| Pork | $1,244 million | $(195) million | $55 million |

| Chicken | $4,141 million | $262 million | $312 million |

| Prepared Foods | $2,396 million | $244 million | $244 million |

Analysis and Commentary

Tyson Foods Inc (TSN, Financial) continues to navigate a challenging market environment, with mixed results across its segments. The beef and pork segments reported operating losses, while chicken and prepared foods showed profitability. The company's focus on operational excellence and cost management is evident in the improved adjusted operating income.

We delivered another solid quarter with growth in both sales and adjusted operating income, driven by strong execution across the business," stated Donnie King, President & CEO of Tyson Foods.

Overall, Tyson Foods Inc (TSN, Financial) demonstrates resilience in its operations, but the significant gap between GAAP and adjusted earnings highlights the ongoing challenges in achieving sustainable profitability. The company's strategic focus on its diversified portfolio and operational efficiency will be critical in navigating future market dynamics.

Explore the complete 8-K earnings release (here) from Tyson Foods Inc for further details.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10