Bright Horizons (NYSE:BFAM) Reports Q1 In Line With Expectations

Child care and education company Bright Horizons (NYSE:BFAM) met Wall Street’s revenue expectations in Q1 CY2025, with sales up 6.9% year on year to $665.5 million. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $2.89 billion at the midpoint. Its non-GAAP profit of $0.77 per share was 19.5% above analysts’ consensus estimates.

Is now the time to buy Bright Horizons? Find out in our full research report.

Bright Horizons (BFAM) Q1 CY2025 Highlights:

- Revenue: $665.5 million vs analyst estimates of $665.5 million (6.9% year-on-year growth, in line)

- Adjusted EPS: $0.77 vs analyst estimates of $0.64 (19.5% beat)

- Adjusted EBITDA: $92.3 million vs analyst estimates of $85.55 million (13.9% margin, 7.9% beat)

- The company slightly lifted its revenue guidance for the full year to $2.89 billion at the midpoint from $2.88 billion

- Management reiterated its full-year Adjusted EPS guidance of $4.05 at the midpoint

- Operating Margin: 9.4%, up from 6.4% in the same quarter last year

- Free Cash Flow Margin: 10.7%, down from 15.6% in the same quarter last year

- Market Capitalization: $7.35 billion

“We are pleased with our solid start to the year,” said Stephen Kramer, Chief Executive Officer.

Company Overview

Founded in 1986, Bright Horizons (NYSE:BFAM) is a global provider of child care, early education, and workforce support solutions.

Sales Growth

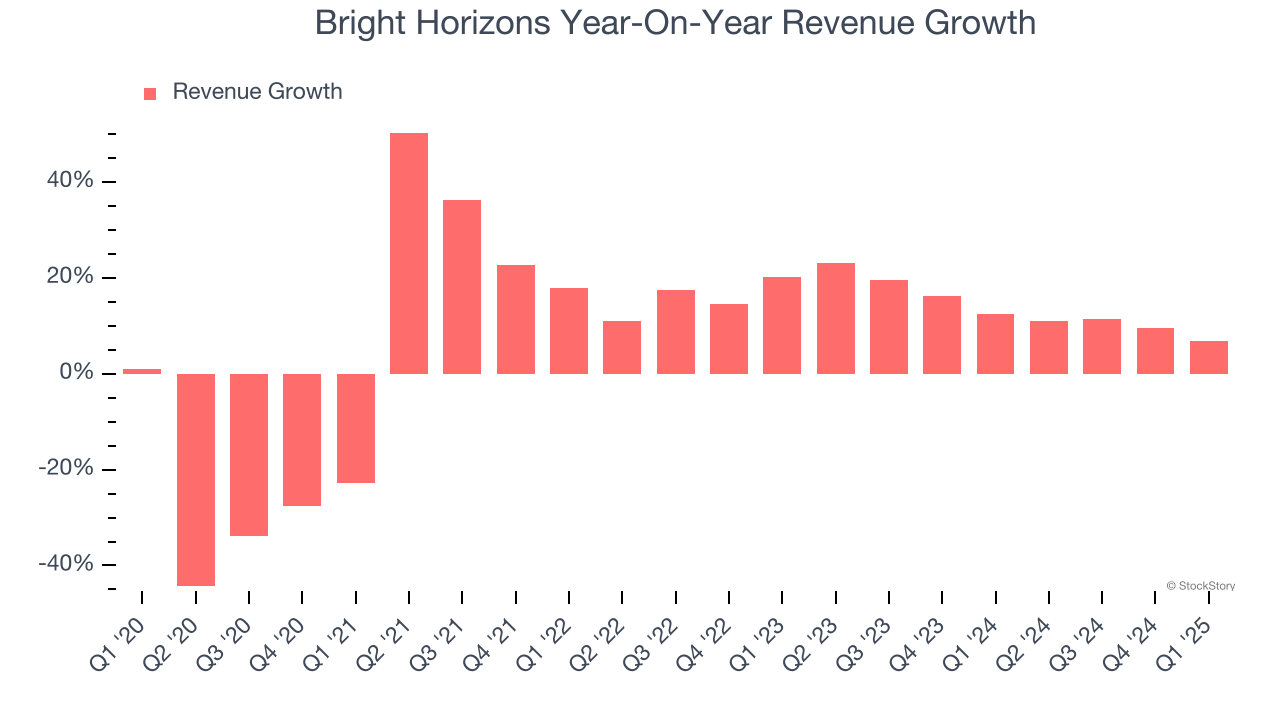

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Bright Horizons grew its sales at a sluggish 5.7% compounded annual growth rate. This was below our standard for the consumer discretionary sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Bright Horizons’s annualized revenue growth of 13.6% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, Bright Horizons grew its revenue by 6.9% year on year, and its $665.5 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 7.2% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Bright Horizons’s operating margin has risen over the last 12 months and averaged 8.6% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports mediocre profitability for a consumer discretionary business.

This quarter, Bright Horizons generated an operating profit margin of 9.4%, up 2.9 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Bright Horizons’s flat EPS over the last five years was below its 5.7% annualized revenue growth. However, its operating margin didn’t change during this time, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

In Q1, Bright Horizons reported EPS at $0.77, up from $0.51 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Bright Horizons’s full-year EPS of $3.74 to grow 11.5%.

Key Takeaways from Bright Horizons’s Q1 Results

We enjoyed seeing Bright Horizons beat analysts’ EPS expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock remained flat at $127.30 immediately following the results.

Is Bright Horizons an attractive investment opportunity at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10