DoorDash Just Went on a $5 Billion Shopping Spree--Here's What Everyone's Missing

DoorDash (DASH, Financial) just pulled off a double strike that could reshape the global food and hospitality tech landscape. In less than a day, it announced two massive acquisitions: UK-based Deliveroo for $3.9 billion and restaurant software firm SevenRooms for $1.2 billion. If approved, these deals will take DoorDash from a U.S. delivery giant to a global local commerce player with a footprint in over 40 countries and access to 50 million monthly users. Deliveroo adds international scale. SevenRooms brings restaurant CRM and reservation tech used by major brands like Marriott and MGM. CFO Ravi Inukonda framed it as a move to bring the company's proven U.S. product experience to a broader global audience.

The market blinked—shares dropped nearly 6.7% at 12.14pm —but the business fundamentals held firm. Q1 gross order value exceeded expectations, and DoorDash is guiding even higher this quarter: $23.3 to $23.7 billion, beating Wall Street's estimates. Net income came in at $193 million, above consensus, and grocery delivery stood out as a growth engine with rising consumer spend. The only red flag? Adjusted EBITDA guidance missed slightly at the midpoint, thanks to spending on international expansion. Still, the company's message is clear: strong consumer engagement, expanding verticals, and confidence to invest heavily.

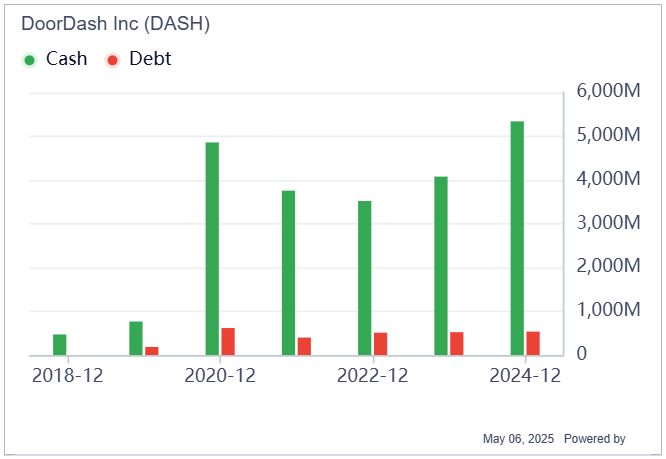

And DoorDash has the balance sheet to back it up. While debt levels have stayed relatively modest in recent years, cash reserves have rebounded significantly since 2022—climbing to their highest level by the end of 2024.

Even with a $2.85 billion bridge loan to help fund the Deliveroo deal, the company is operating from a position of financial strength, not desperation. If execution matches vision, this may be the moment DoorDash shifts from dominating U.S. delivery to owning a much bigger slice of global commerce.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10