Novo Nordisk A/S (NYSE:NVO) is seeking FDA approval for the pill version of its obesity drug, Wegovy. The company recently highlighted early data that shows safety and efficacy figures that are similar to its injectables.

What Happened: On Wednesday, during Novo’s first quarter earnings call, the company highlighted its upcoming oral weight loss drug, which CEO Lars Fruergaard calls “Wegovy in a pill,” and is currently under review by the U.S. Food and Drug Administration.

“If approved, this will be the first oral GLP-1 treatment for obesity in the United States,” Fruergaard said, adding that being first to market with a “known molecule, known efficacy, known safety” positions the company well in what he described as a smaller, but meaningful, segment of the market.

See More: Uber CEO Dara Khosrowshahi Says ‘Average Waymo In Austin Is Busier Than 99%’ Of Human Drivers

Martin Lange, executive vice president of development at Novo, said the 25-milligram oral formulation “demonstrates an overall efficacy and safety profile similar to once-weekly injectable semaglutide 2.4 milligram.”

During the trial, adults struggling with obesity, who received 25 milligrams of oral semaglutide experienced “16.6% average weight loss,” Lange says, with one-third of participants experiencing weight loss of “20% of more.” Lange added that the FDA review is expected to conclude by late 2025 or early 2026.

Why It Matters: The company saw a big surge in Wegovy sales during the first quarter, at $2.63 billion, up 85% year-over-year, as it gears up to launch the oral version of its drug.

This comes amid analyst predictions that rival Eli Lilly And Co.’s (NYSE:LLY) oral weight loss drugs can take share away from Novo’s Semaglutide.

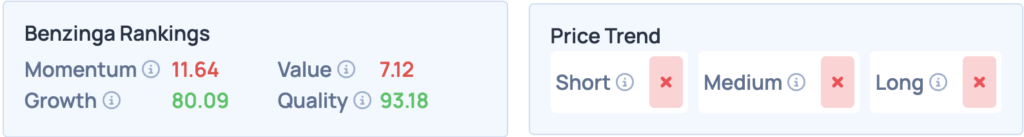

During its first quarter, Novo Nordisk generated $10.9 billion in sales, missing consensus estimates at $11.64 billion, with a profit of $0.92 per share, beating estimates at $0.90.

Price Action: The stock was up 1.90% on Wednesday, but is down 2.38% after hours following the company’s first quarter earnings release.

According to Benzinga Edge Stock Rankings, Novo Nordisk has an unfavorable price trend in the short, medium, and long term. For more insights, sign up for Benzinga Edge.

Photo Courtesy: kikpokemon on Shutterstock.com

Read More: Trump Tariff Pressure Reportedly Opens Global Doors For Elon Musk’s Starlink As Nations Rush To Show ‘Goodwill’