'Held For Sale': Restaurant Brands International Moves Swiftly To Exit Burger King China, Citing Peak Complexity And Drag On Finances

Just months after assuming full control of its underperforming Chinese chain, Restaurant Brands International Inc. (NYSE:QSR) is moving swiftly to offload its Burger King China operations.

What Happened: On Thursday, during its first quarter earnings call, the fast food holding company revealed that it was classifying its Burger King China subsidiary as “held for sale” on its books, while simultaneously engaging Morgan Stanley Inc. to find a new local “controlling shareholder.”

This comes just months after it acquired its remaining equity interest in Burger King China from its former joint venture partners in February.

See Also: Mohamed El-Erian Flags ‘Adverse Implications’ For Domestic Industries As China’s Exports Rise 8% Despite 21% Drop In US Shipments

Restaurant Brands has already made good progress in restructuring the company over the past three months. “We've made great progress in the three months since we bought it,” says Executive Chairman Patrick Doyle.

This involved the closure of several unprofitable stores, a move that was described by CEO Joshua Kobza as “a critical and necessary step to reposition the business for long-term success.”

The unit is already weighing on the company’s finances, according to CFO Sami Siddiqui, who notes that it resulted in a $9 million revenue and operating income headwind during the quarter. “For the full year, assuming no change in ownership, we expect a $37 million impact to revenue and a $19 million impact to AOI [Adjusted Operating Income],” Siddiqui says.

This move underscores the management’s focus on curbing complexity, with Doyle stating, “We're operating in a moment of peak complexity, but our business will get simpler from here,” adding that “We can't control the macro environment, but we can control our complexity.”

Why It Matters: Analysts have been increasingly bullish on the stock in recent months, citing strong same-store-sales figures and a turnaround in China operations.

During its first quarter results on Thursday, the company reported $2.11 billion in revenue, up 21.3% year-over-year, with a profit of $0.75 per share, against $0.73 per share a year ago.

Price Action: The stock was down 0.53% on Thursday and is down another 0.34% after hours following its first quarter results.

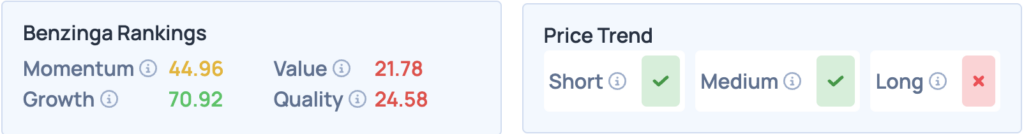

According to Benzinga Edge Stock Rankings, the stock fares well in the short and medium term, but is unfavorable in the long term. For more insights, sign up for Benzinga Edge.

Read More:

- ‘Financial Hurdles To Owning A Home Have Rarely Been Higher,’ Says BMO As Fed Holds Rates, Extending Wait For Homebuyers

Image Via Shutterstock

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10