Quantum Computing Aids Energy Efficiency For Blockchain Hashing: 'Require A Fraction Of The Electricity Used By Classical Resources,' Says D-Wave CEO

After posting record earnings on Thursday, D-Wave Quantum Inc.’s (NYSE:QBTS) management highlighted its progress in enabling energy-efficient measures to enhance blockchain hashing using quantum computing.

What Happened: CEO Alan Baratz highlighted the inference of its recent research paper titled Blockchain with Proof of Quantum Work.

The study showed that quantum computation can be used to generate and validate blockchain hashes. Hashes are unique “digital fingerprints” of data, which makes it easy to detect tampering.

The CEO said that “using quantum computation for hashing and proof of work could potentially require a fraction of the electricity used by classical resources alone and reduce electricity costs by up to a factor of 1000.”

He explained that blockchain “security and efficiency” can be increased by adding quantum to traditional blockchain computation.

“D-Wave scientists deployed the blockchain architecture across four of its cloud-based annealing quantum computers in Canada and the United States, performing distributed quantum computing for the first time,” he said during the earnings call.

Baratz said that D-Wave was eyeing “potential partnerships” after being approached by interested “blockchain-focused organizations.”

See Also: Federal Reserve ‘Will Be The Last To Cut’ Rates, Says Expert Who Still Expects Four Cuts In 2025

Why It Matters: Its first quarter saw a more than sixfold increase in the company’s revenue of $15 million on a year-over-year basis.

Revenue surged on the back of the sale of its Advantage quantum computer to a key research center and wider use of its hybrid offerings.

It reported a loss of 2 cents per share, beating estimates for a loss of 7 cents per share, according to Benzinga Pro. The gross margin zoomed by 92% in the said quarter, with a gross profit of $13.9 million.

QBTS shares were up by 8.43% on a year-to-date basis and 695.42% over a year. On Thursday, the shares closed 51.23% higher.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose on Thursday. The SPY ended 0.70% higher at $565.06, while the QQQ advanced 1.03% to $488.29, according to Benzinga Pro data.

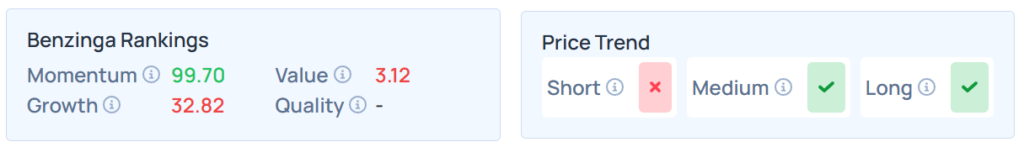

Benzinga Edge Stock Rankings shows that QBTS had a weaker price trend over the short term but a strong price trend across the medium and long term. Its momentum ranking was solid at 99.70th percentile, whereas its value ranking was very poor at 3.12th percentile; the details of other metrics are available here.

Read Next:

- Warren Buffett Falls Behind Nancy Pelosi In Stock Market Returns Over The Last 11 Years: Here’s What Data Shows

Image Credit: A9 STUDIO/Shutterstock

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10