Jupiter crypto jumps 11% as Solana’s DeFi ecosystem grows 7 seconds ago

Jupiter token, powering the biggest dApp on Solana, rose more than 11% during this rally, benefiting from ecosystem growth.

Jupiter (JUP), the biggest DEX aggregator on Solana (SOL), is taking advantage of the latest market rally. On Thursday, May 7, the token was up 11.83%, reaching $0.4622, driven by both market momentum and ecosystem growth.

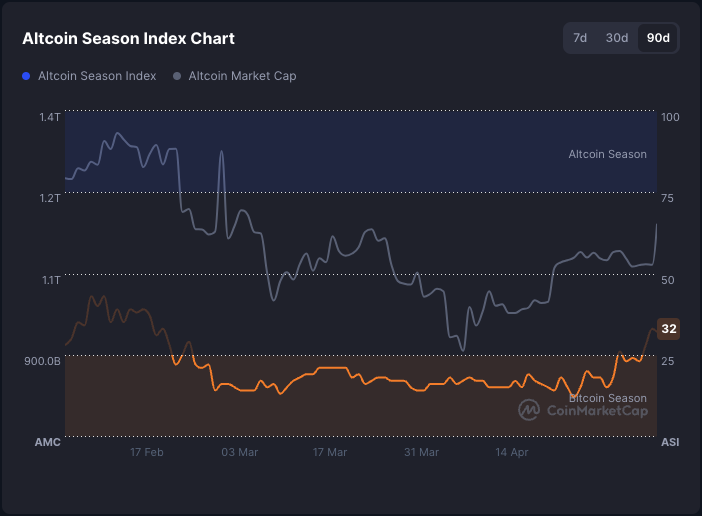

Altcoin momentum has started to pick up, as Bitcoin (BTC) broke above the $100,000 mark. The Altcoin Season Index reached its highest level since February, with 33 out of the top 100 altcoins in the green over the past 30 days.

Notably, Jupiter was not among the best performers during that period. In fact, it was one of the worst, losing 44% of its value over the past 90 days. Still, the strength of Solana’s ecosystem—where Jupiter continues to maintain dominance, is fueling renewed optimism.

Jupiter rises on Solana DeFi Growth

Part of the reason why Jupiter is recovering is thanks to the growth of Solana’s DeFi ecosystem. The surge coincided with Solana’s DEX volume breaking $800 billion so far in 2025. While more than half of this volume was in January, trading volumes remained consistent so far this year.

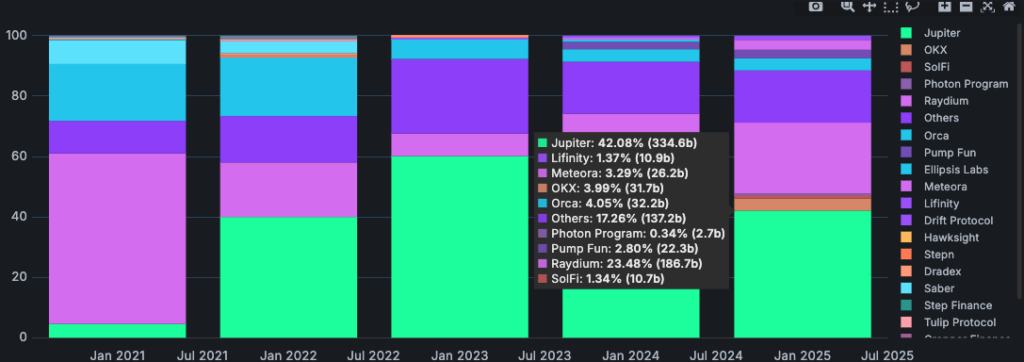

This benefits Jupiter, which maintains a dominant position among Solana-based applications. So far in 2025, its DEX aggregator has accounted for 42%, or $334 billion, of all DEX volume on the chain. Raydium was a distant second, handling 23.48% of the total.

Moreover, Jupiter controls 95% of the market share among DEX aggregators on Solana. As the most popular DeFi app in the ecosystem, Jupiter is well positioned to benefit from Solana’s continued recovery and expanding user base. If ecosystem growth persists, the JUP token is likely to follow.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10