Compass, Inc. (NYSE:COMP) reported worse-than-expected first-quarter financial results on Thursday.

Compass reported quarterly losses of 9 cents per share which missed the analyst consensus estimate of losses of 6 cents per share. The company reported quarterly sales of $1.36 billion which missed the analyst consensus estimate of $1.42 billion.

Robert Reffkin, Founder and Chief Executive Officer of Compass said, “In the first quarter, we continued to widen the gap against the industry as we grew organic transactions by 7.3% and total transactions by 27.8% compared to the market where transactions declined by 2.1% year-over-year, which means organic and total transactions outgrew the market by roughly 9% and 30%, respectively. Organic quarterly market share grew 82 basis points and total quarterly market share grew 125 basis points to 6.0%, which is our highest year-over-year market share increase in 8 quarters and 15 quarters, respectively. These results illustrate that the top agents and teams in the industry continue to take share and Compass has the highest number of both per RealTrends.”

Compass said it sees second-quarter sales of $2.00 billion to $2.15 billion, versus estimates of $2.14 billion.

Compass shares fell 17% to trade at $6.42 on Friday.

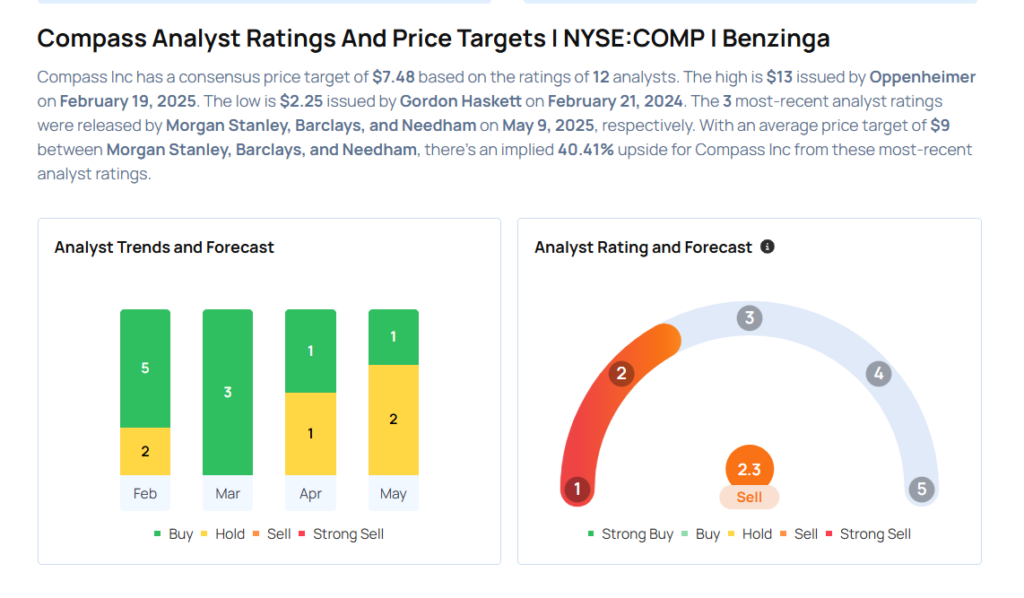

These analysts made changes to their price targets on Compass following earnings announcement.

- Needham analyst Bernie McTernan maintained Compass with a Buy and lowered the price target from $12 to $11.

- Barclays analyst Matthew Bouley maintained the stock with an Equal-Weight rating and lowered the price target from $9 to $8.

- Morgan Stanley analyst Brian Nowak maintained Compass with an Equal-Weight rating and cut the price target from $8.5 to $8.

Considering buying COMP stock? Here’s what analysts think:

Read This Next:

- How To Earn $500 A Month From NRG Energy Stock Ahead Of Q1 Earnings