During its first quarter earnings call on Monday, satellite designer and manufacturer, AST SpaceMobile Inc. (NASDAQ:ASTS) gave a concrete revenue guidance for the first time, forecasted between $50 million to $75 million, heavily weighted to the back half of this year.

What Happened: “We believe we have a revenue opportunity in 2025 in the range of $50 million to $75 million, back-end loaded in the second half of the year,” CFO Andrew Johnson said during the call. “Revenue is ramping on plan,” he said, from satellite deployments, gateway installations, and milestone payments under government and mobile operator agreements.

See Also: Ed Yardeni Slashes Recession Odds To 25% After US Stocks Rally, Lifts S&P 500 Year-End Target To 6,500

The company credited its rapid monetization progress to AST's direct-to-device technology, which allows unmodified mobile devices to connect directly with its growing network of low Earth orbit communication satellites.

“We're building the first and only global cellular broadband network in space to operate directly with everyday unmodified mobile devices,” said President Scott Wisniewski.

“If you can run a video call, you can support basically any native application that is in your phone,” said CEO Abel Avellan, highlighting recent video call demonstrations conducted with partners including AT&T Inc. (NYSE:T), Verizon Communications Inc. (NYSE:VZ), Vodafone Group Plc (NASDAQ:VOD), and Rakuten Group Inc. (OTC:RKUNY).

Why It Matters: With its direct-to-device technology, AST SpaceMobile is targeting more than 3 billion potential users, part of the 42% of the global population currently lacking cellular coverage. The company has already signed agreements with 45 mobile network operators worldwide to help extend its reach.

During its recent first quarter results on Monday, the company reported $718,000 in revenue, up 43.60% year-over-year, but this fell short of consensus estimates by $3.13 million. The company posted a loss of $0.20 per share, which was again $0.01 over analyst estimates.

Price Action: The stock was up 5.43% on Monday, but is down 3.08% after hours following the company’s first quarter results that fell short of estimates.

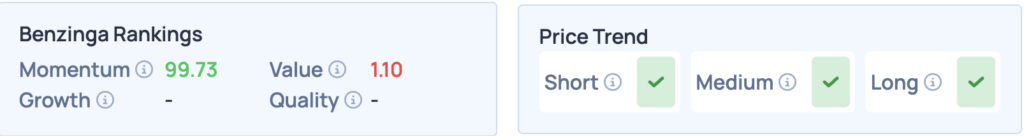

According to Benzinga Edge Stock Rankings, the stock has a strong Momentum score and a favorable price trend in the short, medium, and long term. For more such insights, sign up for Benzinga Edge.

Image Via Shutterstock

Read More:

- ‘Pharma Bro’ Martin Shkreli Rips Into Quantum Stocks: ‘Nothing Is Happening’—Accuses IONQ, D-Wave Quantum, And Others Of Revenue Gimmicks