Applied Materials Falls Over 6% In Pre-Market Trading On Friday, Despite Earnings Beat And Record Margins As Investors Focus On China Headwinds And Widened Outlook

A beat on earnings, soaring margins, and fresh buyback authorizations weren’t enough for investors of Applied Materials Inc. (NASDAQ:AMAT), as they remain fixated on China, volatility, and a widening guidance.

What Happened: Shares of California-based Applied Materials are down 5.83% pre-market, following the company’s second quarter earnings release on Thursday.

The company, which supplies capital equipment to the semiconductor industry, posted $2.39 per share in earnings, beating consensus estimates by $0.08. Gross profit margins stood at 49.2%, the highest recorded since the year 2000, “primarily driven by a favorable mix of our products and business segments,” says CFO Brice Hill.

See Also: Walmart E-Commerce Turns Profitable For The First Time: Despite Reduced Tariffs, CEO Says Full Impact Can’t Be Absorbed, Price Hikes Likely

During the quarter, it returned $2 billion to investors in the form of dividends and stock buybacks, having bought back “approximately 1.4% of total shares outstanding.” Besides this, Applied Materials approved an additional $10 billion in buyback authorizations, bringing its total pending authorizations to $15.9 billion for future repurchases.

Yet, investors remained fixated on a handful of negatives during the quarter, starting with the widening of its revenue outlook for the third quarter by $100 million, to factor in macroeconomic and trade-related volatility. “We widened our range by $100 million… and so we thought it was a good time to widen the range,” Hill said during the call.

China also remained a flashpoint with continued headwinds from trade restrictions affecting sales of both equipment and services. “In the near term, that business is down from where it was at previously,” said CEO Gary Dickerson, referring to the company's 200mm tool business tied to power electronics, much of which is exposed to China.

Why It Matters: Market reactions aside, the company had a strong second quarter performance, with $7.1 billion in revenue, up 6.83% year-over-year, and just a smidge short of consensus estimates at $7.13 billion.

Profits stood at $2.39 per share, coming in ahead of estimates at $2.31. The company’s CFO, Hill said during the results that “Despite the dynamic economic and trade environment, we have not seen significant changes to customer demand and are well-equipped to navigate evolving conditions with our robust global supply chain and diversified manufacturing footprint.”

Price Action: The stock was up 0.35% on Thursday, at $174.75 per share, but is down 6.19% pre-market, following its earnings release.

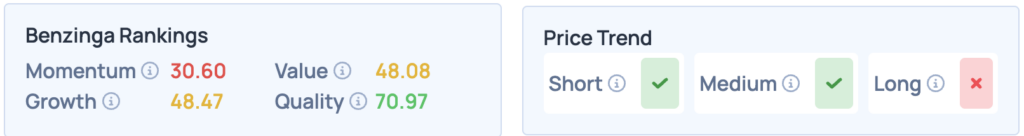

Benzinga’s Edge Stock Rankings show that AMAT has a strong price trend in the short and medium terms, but is unfavorable in the long run. Other key metrics and more comprehensive insights are available here.

Image Via Shutterstock

Read More:

- Trump Announces $200 Billion In US-UAE Deals, Etihad Orders 28 Boeing Jets Worth $14.5 Billion

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10