UnitedHealth Group Inc (NYSE:UNH) announced Tuesday morning that its CEO, Andrew Witty, will resign for personal reasons..

Stephen Hemsley, who previously held the CEO title from 2006 to 2017, will succeed him. Hemsley will also remain chairman of UnitedHealth's board of directors, and Witty will become senior adviser to the CEO.

The company also revealed that it would suspend its 2025 outlook, citing that care activity continued to accelerate.

UnitedHealth noted broadening to more types of benefit offerings than seen in the first quarter, and the medical costs of many Medicare Advantage beneficiaries new to UnitedHealthcare remained higher than expected.

It said it "expects to return to growth in 2026," according to the announcement.

The insurance giant reported adjusted EPS of $7.20 in April, up from $6.91 a year ago, missing the consensus of $7.29. Revenues increased 6.8% year over year to $109.6 billion, missing the consensus of $111.60 billion.

UNH shares gained 2.7% to trade at $319.78 on Wednesday.

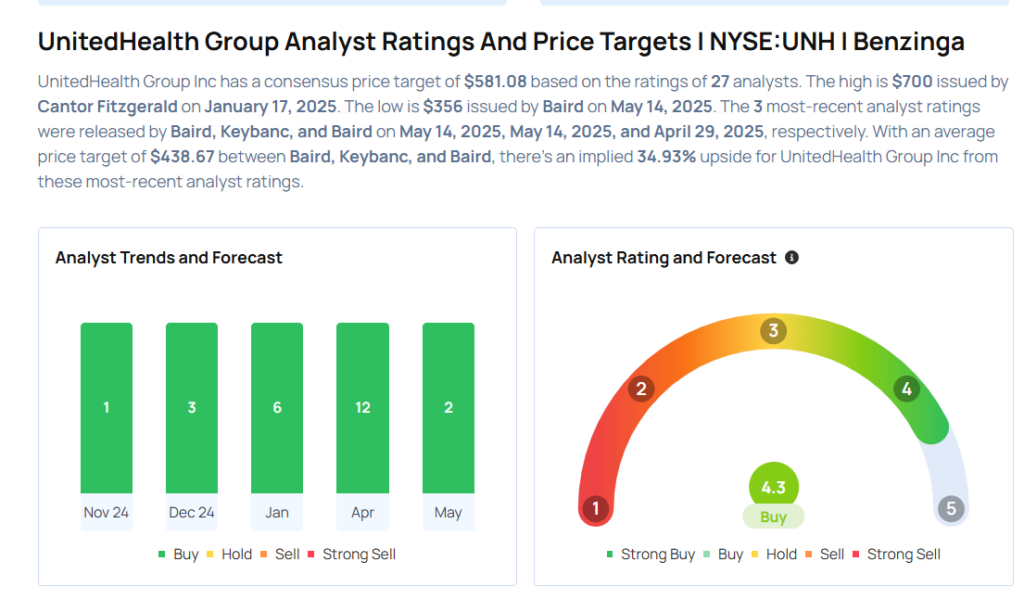

These analysts made changes to their price targets on UNH following the announcement.

- Keybanc analyst Matthew Gillmor maintained UnitedHealth Group with an Overweight rating and lowered the price target from $575 to $450.

- Baird analyst Michael Ha maintained UnitedHealth Group with an Outperform rating and lowered the price target from $510 to $356.

Considering buying UNH stock? Here’s what analysts think:

Read This Next:

- Top 3 Materials Stocks That Could Blast Off This Month

Photo via Shutterstock