Boot Barn Holdings, Inc. (NYSE:BOOT) posted downbeat earnings for its fourth quarter, but issued first-quarter guidance with its midpoint above estimates.

Boot Barn reported quarterly earnings of $1.22 per share, which missed the analyst consensus estimate of $1.24. Quarterly revenue of $453.75 million missed the Street estimate of $458.42 million.

"Our team delivered a solid finish to fiscal year 2025 highlighted by 15% annual total sales growth and 23% growth in earnings per diluted share, underscoring the ongoing resilience of our core consumer despite broader market uncertainties. The continued strength across major merchandise categories, channels, and geographies reaffirms the broad appeal of our brand and the effectiveness of our strategic initiatives," said CEO John Hazen.

Boot Barn said it expects first-quarter EPS of between $1.44 and $1.52, versus the $1.44 analyst estimate, and revenue in a range of $483 million to $491 million, versus the $486.49 million estimate.

The company also announced a $200 million share repurchase program.

Boot Barn shares gained 15% to trade at $152.74 on Thursday.

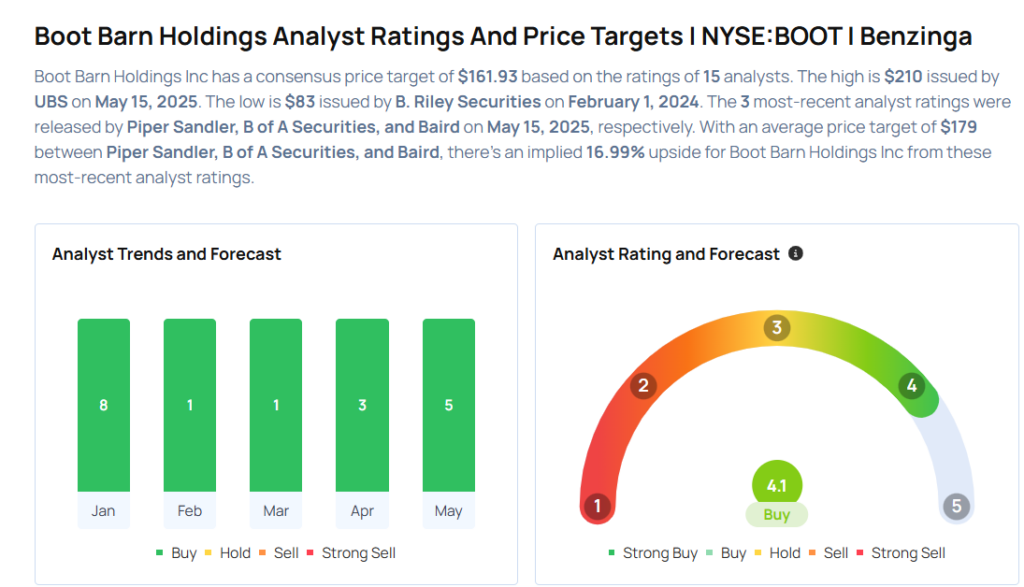

These analysts made changes to their price targets on Boot Barn following earnings announcement.

- JP Morgan analyst Matthew Boss maintains Boot Barn with an Overweight rating and lowered the price target from $209 to $196.

- UBS analyst Jay Sole maintained the stock with a Buy and raised the price target from $156 to $210.

- Baird analyst Jonathan Komp maintained Boot Barn with an Outperform rating and raised the price target from $140 to $180.

- B of A Securities analyst Jason Haas maintained the stock with a Buy and raised the price target from $160 to $173.

- Piper Sandler analyst Peter Keith maintained Boot Barn with an Overweight rating and raised the price target from $162 to $184.

Considering buying BOOT stock? Here’s what analysts think:

Read This Next:

- Jim Cramer: SoFi Goes To ‘New Highs,’ Recommends Not Buying This Health Care Stock

Photo via Shutterstock