Globant S.A. (NYSE:GLOB) reported worse-than-expected first-quarter financial results, issued second-quarter guidance below estimates, and cut its FY25 guidance, after the closing bell on Thursday.

Globant reported quarterly earnings of $1.50 per share which missed the analyst consensus estimate of $1.58 per share. The company reported quarterly sales of $611.09 million which missed the analyst consensus estimate of $621.38 million.

“Globant’s spirit of building and reinvention is stronger than ever. We are largely focused on AI-related opportunities, and assisting our clients in transforming their respective businesses and leveraging technology to drive growth and competitive advantages. Our comprehensive growth strategy unites our 100-squared client-centric vision with our industry-specialized AI Studios and subscription model. This strategy is powered by our AI Pods and the Globant Enterprise AI platform, which we believe positions Globant as the only player in the industry with such a comprehensive offering. With a robust pipeline and expected sequential growth for Q2, we are not just navigating the future; as builders, we are actively creating it, reaffirming our commitment to lead the next wave of technological transformation,” said Martín Migoya, Globant’s CEO and co-founder.

Globant shares gained 3.1% to trade at $104.67 on Monday.

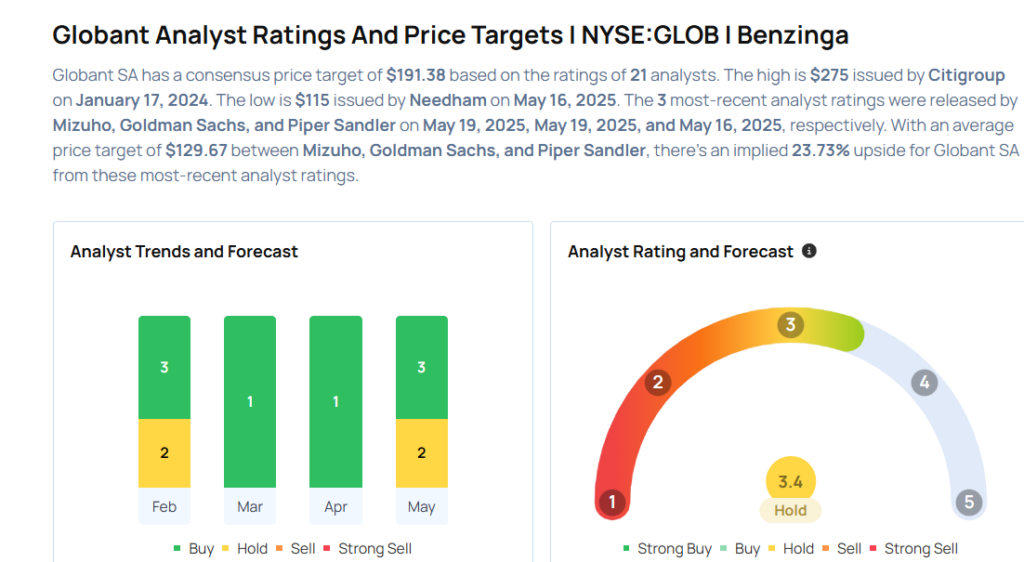

These analysts made changes to their price targets on Globant following earnings announcement.

- Goldman Sachs analyst James Schneider maintained Globant with a Neutral and lowered the price target from $225 to $120.

- Mizuho analyst Dan Dolev maintained the stock with an Outperform rating and lowered the price target from $194 to $153.

Considering buying GLOB stock? Here’s what analysts think:

Read This Next:

- 5 Stock Picks Last Week From Wall Street’s Most Accurate Analysts

Photo via Shutterstock