These Analysts Revise Their Forecasts On Advanced Drainage Systems After Q4 Earnings

Advanced Drainage Systems, Inc. (NYSE:WMS) reported worse-than-expected fourth-quarter financial results and issued FY26 sales guidance below estimates on Thursday.

Advanced Drainage Systems reported quarterly earnings of $1.03 per share which missed the analyst consensus estimate of $1.10 per share. The company reported quarterly sales of $615.76 million which missed the analyst consensus estimate of $653.22 million.

Scott Barbour, President and Chief Executive Officer of ADS, said, “In Fiscal 2025, domestic construction market sales increased 3% as we continued to drive above market performance through our material conversion strategy in the stormwater and onsite wastewater markets. Importantly, organic sales in our most profitable segments, Infiltrator and Allied Products, increased 4.6% and 2.5%, respectively, and the onsite wastewater and Allied products now represent a collective 44% of revenue. The resiliency demonstrated by this year’s 30.6% Adjusted EBITDA margin is due in part to our strategy to grow these more profitable products to be a higher mix of the overall sales.”

Advanced Drainage Systems said it sees FY2026 sales of $2.825 billion to $2.975 billion, versus market estimates of $3.07 billion.

Advanced Drainage shares gained 3% to trade at $121.09 on Friday.

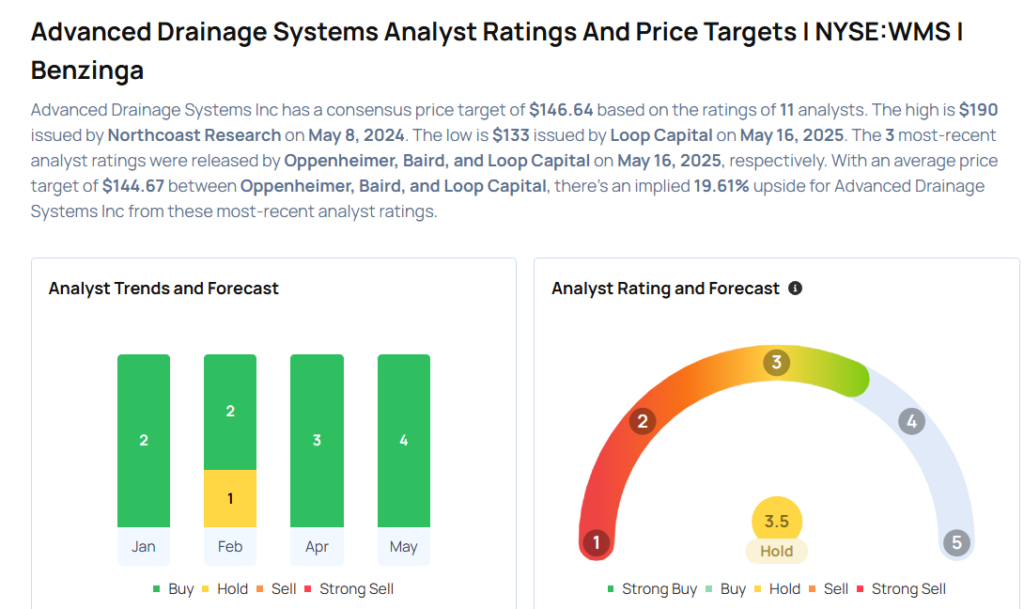

These analysts made changes to their price targets on Advanced Drainage following earnings announcement.

- Barclays analyst Matthew Bouley maintained Advanced Drainage Systems with an Overweight rating and raised the price target from $130 to $135.

- Loop Capital analyst Garik Shmois maintained the stock with a Buy and lowered the price target from $143 to $133.

- Baird analyst Michael Halloran maintained Advanced Drainage Systems with an Outperform rating and lowered the price target from $146 to $141.

- Oppenheimer analyst Bryan Blair maintained the stock with an Outperform rating and lowered the price target from $165 to $160.

Considering buying WMS stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Prefers AutoZone Over Rival: ‘Buy The One That’s Not Going To Stock Split’

Photo via Shutterstock

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10