Despite the overvalued nature of the stock based on its price-to-earnings metric, Tesla Inc. (NASDAQ:TSLA)’s CEO, Elon Musk, has defended the company’s growth, citing its stock prices, shrugging off the fundamental worries surrounding the carmaker as highlighted by experts.

What Happened: During the Qatar Economic Forum on Monday, Musk highlighted that Tesla’s share price was the measure of its business’s success.

“You can just look at the stock price if you want the best inside information,” he said as per a Yahoo Finance report.

“The stock market analysts have that, and a stock wouldn’t be trading near all-time highs if it was not, if things weren’t in good shape. They’re fine, don’t worry about it.”

According to Benzinga Pro, Tesla shares are trading at a price nearly 158.730 times its 2026 earnings. At the same time, the average forward price-to-earnings of its peers stood at 25.75 times, implying that Tesla was 6.16 times more expensive than its industry's average.

However, Gordon Johnson, the CEO and founder of GLJ Research, countered Musk’s statement with examples. In an X post, he highlighted that “If: high stock price = good underlying business fundamentals, then WorldComm + HealthSouth + Enron + Tyco + etc. would never have gone bankrupt.”

He explained that the stock prices were simply a reflection of a stock’s demand, which could be influenced by factors like CEO comments and pump-and-dump Wall Street analysts.

Taking a dig at the Federal Reserve and Treasury Secretary Scott Bessent, Johnson further stated that the Fed’s purchase of Treasuries by printing money was also a reason for the artificially created demand for stocks.

“Were the Federal Reserve to immediately pull out all the money it printed into existence from COVID, we’d QUICKLY have REAL price discovery in stocks,” he warned.

I was going to comment on this… but @FredericLambert NAILS it. If: high stock price = good underlying business fundamentals, then WorldComm + HealthSouth + Enron + Tyco + etc. would never have gone bankrupt. Stock price simply = demand for the stock (and demand for a stock can… https://t.co/LmKs67YUH1

— Gordon Johnson (@GordonJohnson19) May 20, 2025

As of the first quarter, Tesla’s revenue fell 9% year-over-year to $19.34 billion, missing the Street’s consensus estimate of $21.35 billion, and its EPS declined 40% year-over-year to 27 cents, which was below the 31 cents consensus.

See Also: Charlie Munger Once Said, ‘The First Rule Of Compounding Is To Never Interrupt It Unnecessarily’ — Now His Wisdom Rings True As The S&P 500 Surges 220% Over 10 Years

Why It Matters: When compared to a few of its industry peers, Tesla had the highest trailing P/E ratio among them.

| Stocks | Trailing P/E |

| Tesla Inc. (NASDAQ:TSLA) | 196.469 |

| Toyota Motor Corp. (NYSE:TM) | 0.05 |

| General Motors Co. (NYSE:GM) | 6.96 |

| Ford Motor Co. (NYSE:F) | 8.54 |

| Honda Motor Co Ltd. (NYSE:HMC) | 0.06 |

However, when compared to the forward P/E ratios of the Magnificent 7 stocks, Tesla shares remain the most expensive with the highest ratio of forward price-to-earnings in comparison with its industry average.

| Stocks | Forward P/E | Industry Average |

| Tesla Inc. | 158.73 | 25.75 |

| Nvidia Corporation (NASDAQ:NVDA) | 31.153 | 37.03 |

| Apple Inc. (NASDAQ:AAPL) | 28.818 | 20.23 |

| Microsoft Corp. (NASDAQ:MSFT) | 30.488 | 81.74 |

| Amazon.com Inc. (NASDAQ:AMZN) | 31.646 | 32.14 |

| Alphabet Inc. (NASDAQ:GOOG) | 17.575 | 125.77 |

| Meta Platforms Inc. (NASDAQ:META) | 25.189 | 125.77 |

TSLA shares were down 9.35% year-to-date, but it has returned by 51.13% just in the last month. The shares were up 84.26% over the year. On Tuesday, it ended 0.51% lower and advanced 0.015% in after-hours and on Wednesday, it was up 0.46%.

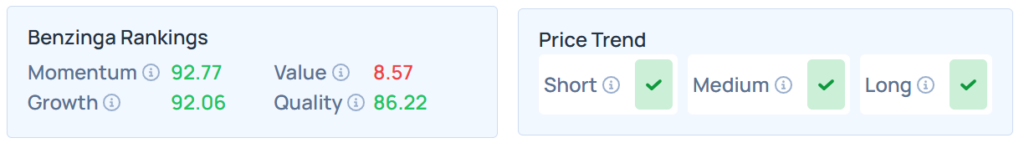

Benzinga Edge Stock Rankings shows that Tesla had a stronger price trend over the short, medium, and long term. Its momentum ranking was solid, however, its value ranking was poor at the 8.57th percentile. The details of other metrics are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, fell in premarket on Wednesday. The SPY was down 0.70% to $588.69, while the QQQ declined 0.76% to $516.31, according to Benzinga Pro data.

Read Next:

- MSTR’s New Bitcoin Accounting Standard To Drive ‘Financial Swings,’ Make Earnings ‘Volatile,’ Says Expert After Lawsuit Hits Strategy

Image Via Shutterstock