QuantumLight Raises $250 Million for Systematic Investment Fund

- QuantumLight raised $250 million, exceeding its original target.

- New fund aims to identify high-potential growth companies.

- Investment focus includes AI, Web3, FinTech, and more.

Nik Storonsky's QuantumLight, a quantitative venture capital firm, announced a $250 million fund completion aimed at systematic investments in tech sectors using its AI model, Aleph.

The completion of this fund signifies a strong belief in AI-driven investment strategies, aiming to capture growth opportunities across AI, Web3, and FinTech industries.

QuantumLight's $250M Fund Signals AI's Role in Investment

QuantumLight announced the successful close of its first fund, raising $250 million, surpassing initial targets. This fund was raised under the leadership of Nik Storonsky and focuses on sectors including AI, Web3, and FinTech. QuantumLight employs an AI model, Aleph, for investment decision-making. Areas such as HealthTech and SaaS are also receiving investment interest. The completion indicates a robust investor confidence in QuantumLight's tech-driven approach and model.

The fund's focus broadens investment capital within emerging technologies while utilizing AI for predictive investment.

Industry reactions indicate positive reception to QuantumLight's success. Storonsky's leadership and model deployment are noted as innovative approaches. ChainCatcher details advanced AI and investment convergence as a current trend in VC firms.

Broader Implications and Market Influence of AI-Driven Ventures

Did you know? QuantumLight's innovative use of AI like Aleph for investment decisions reflects a growing trend where AI-driven models are poised to transform traditional investment methodologies, showcasing the interplay between advanced technology and finance.

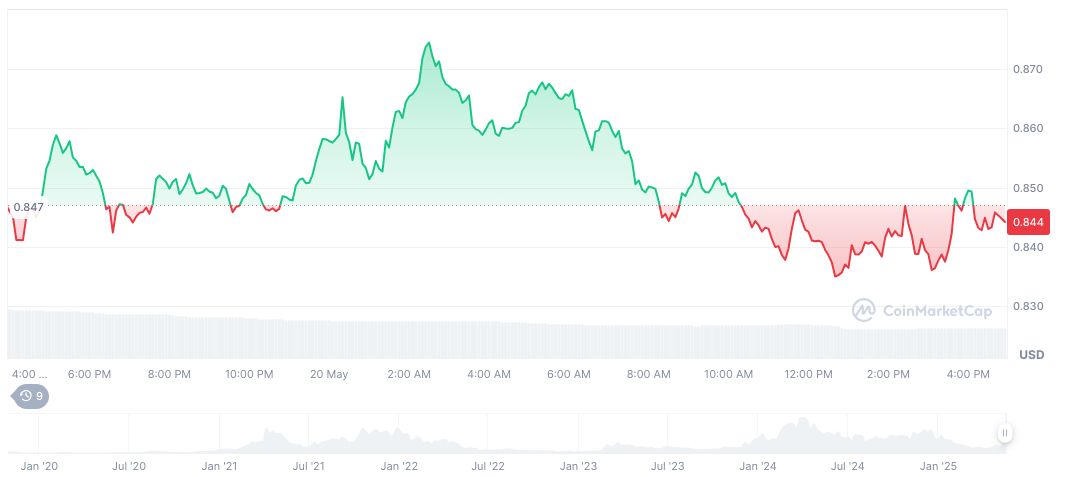

According to CoinMarketCap, Stacks (STX) shows a market cap of 1.32 billion. In the past 60 days, the cryptocurrency reported a 39.87% price surge. Current trading at $0.86 reflects some volatility with a 12.80% dip over the week, despite a 22.19% monthly increase.

Insights suggest QuantumLight's approaches may influence broader venture strategies. The Coincu research team highlights AI advancements, pushing financial innovation boundaries. "Our updated roadmap highlights our commitment to enhancing the Stacks ecosystem," said the Stacks Development Team, "focusing on DeFi growth strategies, and improving block production efficiency."

Read original article on coincu.com免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10