Ross Stores, Inc. (NASDAQ:ROST) posted better-than-expected quarterly results, but issued second-quarter EPS guidance below estimates.

Ross Stores reported quarterly earnings of $1.47 per share, which beat the Street estimate of $1.44. Quarterly revenue came in at $4.99 billion, which beat the $4.97 billion consensus estimate.

Ross Stores said it sees second-quarter GAAP EPS in a range of $1.40 to $1.55, versus the $1.65 analyst estimate.

"Despite the slower start to the spring selling season in February, our monthly sales performance improved sharply, month after month, for the balance of the quarter. For the first quarter, sales and earnings performed at the high end of our expectations while operating margin of 12.2% was flat year-over-year," Jim Conroy, CEO of Ross Stores, commented. "Given the varying nature of tariff announcements, we are only providing an outlook for the second quarter at this time and are withdrawing our previously provided annual sales and earnings guidance."

Ross Stores shares dipped 13.1% to $132.32 on Friday.

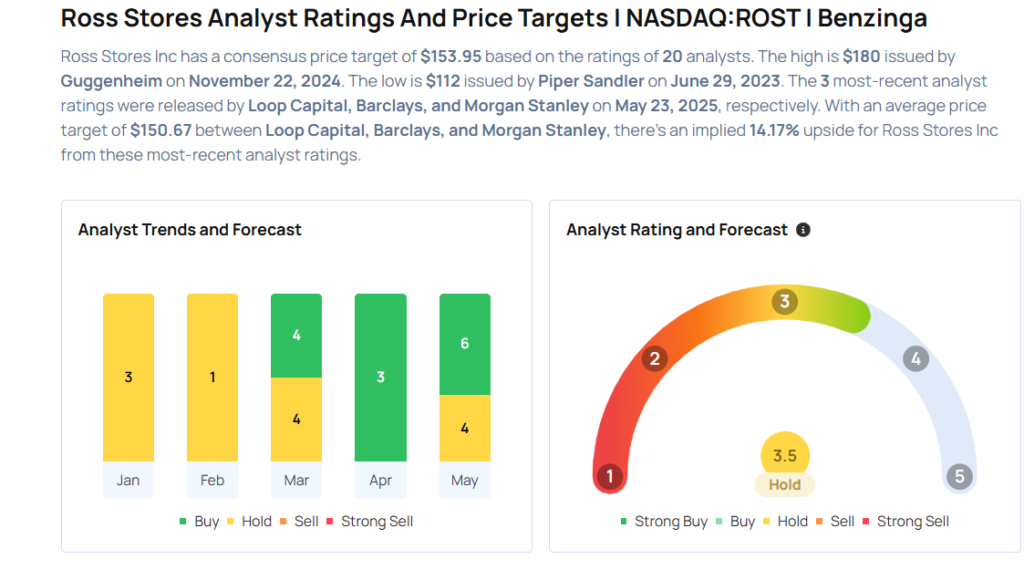

These analysts made changes to their price targets on Ross Stores following earnings announcement.

- JP Morgan analyst Matthew Boss maintained Ross Stores with an Overweight rating and lowered the price target from $161 to $141.

- Evercore ISI Group analyst Michael Binetti maintained Ross Stores with an Outperform rating and lowered the price target from $170 to $160.

- Morgan Stanley analyst Alex Straton maintained Ross Stores with an Equal-Weight rating and lowered the price target from $128 to $126.

- Loop Capital analyst Laura Champine maintained Ross Stores with a Buy and lowered the price target from $175 to $170.

- Barclays analyst Adrienne Yih maintained the stock with an Overweight rating and cut the price target from $157 to $156.

Considering buying ROST stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Says Medical Properties Trust Has ‘Too Much Risk,’ Likes This Industrial Stock

Photo via Shutterstock