Billionaire Bill Ackman Just Sold His Entire Position in Nike Stock and Piled Money Into a Growth Stock That's Up 53% This Year

-

Ackman is still betting on Nike's recovery, but he's minimizing his risk.

-

He sees Uber as a contrarian bet, but the low valuation made it compelling.

Investors love to see what billionaire hedge fund managers buy and sell. Hedge funds provide quarterly updates about their performance, and they also file a quarterly 13F that details their trades. Since it's public information, it's easy to track, and some fund managers give transparent analyses about their trades.

Bill Ackman has risen to prominence as the head of Pershing Square Capital, and his fund only owns around 10 stocks at any given time, making for an intriguing fund to follow. Pershing Square started a position in sneaker king Nike (NKE -4.16%) last year, but it sold out of the stock in the first quarter of 2025. At the same time, it initiated a position in rideshare company Uber (UBER -3.60%), which is on a tear this year. Let's see what Ackman is thinking.

Luka Dončić. Image source: Nike.

Out of Nike stock, but still betting on a recovery

Pershing Square's position in Nike accounted for about 11% of its total portfolio before it sold, making it the sixth-largest position in the fund.

Ackman already described in great detail what his thinking was in selling Nike stock in Pershing Square's 2024 annual report. He laid out three key ways Nike messed up: its switch to focusing on a direct-to-consumer strategy at the expense of wholesale partnerships, a merchandising structure that didn't prioritize sports, and overproduction of best-selling franchises in place of working harder on innovation.

He acknowledged that Nike is the dominant leader in a highly consolidated industry, and that it has long-term tailwinds of wealth and wellness and what he called "casualization." That makes it worth a long-term investing bet. He explained that despite what looks like a loss of confidence in Nike stock, he converted all of the company's Nike investment into call options instead, which he described as a "deep-in-the-money" strategy. Call options allow Pershing Square to buy Nike at a set price with a long-term duration, minimizing loss while maintaining exposure. "In a successful turnaround, the option payoffs should be more than double the returns from owning the common stock. We continue to believe that Nike has the potential to be one of the great large-cap consumer turnarounds," he wrote.

If Nike does turn around, it has quite a long way to go, and Ackman doesn't want his fund's money tied up in the turnaround. In the fiscal 2025 third quarter (ended Feb. 28), sales were down 9% from last year. It was felt more in the direct-to-consumer channels, which reported a 12% drop, and it trickled down to a 3.3 percentage-point decrease in gross margin.

Ackman's strategy suggests he thinks the stock might keep going lower before it rebounds. This gives him the opportunity to take big profits when the turnaround happens.

Image source: Getty Images.

Into Uber stock, up 53% this year

Ackman started a position in Uber in the 2025 first quarter, and it's already the top position, accounting for nearly 18% of the total portfolio.

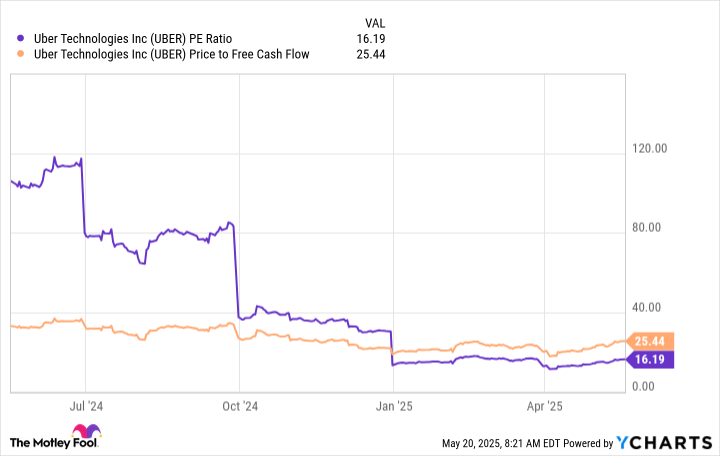

He explained that there was a decline in the valuation toward the end of 2024, and he grabbed the opportunity. He's probably already made money on this play, and the stock still looks quite cheap today.

UBER PE Ratio data by YCharts

He sang the company's praises in the annual letter, explaining how it's well-run, has low costs, and has massive opportunities. He explained that Uber's scale, management, and network effects are creating the conditions for high growth. Its platform aggregates demand from millions of users, leading to low prices and quick pickups. That leads to a cycle of greater demand from new members and higher frequency, more drivers, and a larger ecosystem with a robust moat. He cited bookings growth of 20% compounded annually since 2019, which is at $160 billion today, and he believes earnings can grow by at least 30% in the medium term, making it a great value at the price he bought it at, and still today.

Finally, he admitted that this was a contrarian view, but he said most investors are focused on the risks of autonomous vehicles (AVs) instead of Uber's value proposition and the benefits of AVs. The worry with Uber is that AVs will take over ridesharing and Uber will become obsolete. Ackman counters that worry by explaining that AVs are still going through upgrades, and that high fatality rates make them unlikely to take over any time soon. On top of that, he sees Uber's advantage in its dynamic supply model. Because Uber drivers are out on the road at the same times riders need them, it creates a self-regulating supply mechanism. He imagines that when AVs do become safer, Uber can integrate them into this mechanism. "Some of the best investment opportunities occur when one has a contrarian view on a business or an industry," he wrote.

Uber might not be a stock for the most risk-averse investor, but it could be a long-term winner for those who can handle a bit of risk.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10